Users: bajaman: Slope Of Hope with Tim Knight

Slope Of Hope with Tim Knight

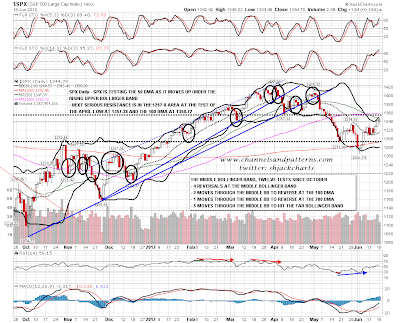

I was watching for a possible strong reversal yesterday but there was nothing to see, with the day following the standard bull format of early weakness followed by a rise for the rest of the day. On the daily chart SPX tested the 50 DMA, walking up the now rising upper bollinger band, and getting closer to the next serious resistance level above at 1357-8, with the April low at 1357.38 and the 100 DMA at 1358.72:

Continue reading "Looking Increasingly Bullish (by Springheel Jack)" »

Have we bottomed for the summer? The simple answer is, quite possibly.

My work was looking for three things to come together:

A break of the October '11 lows for leading stocks/indices, such as GDOW, BHP, ITUB, & SU A spike higher in VIX, possibly to the low 40's An early June low, followed by a 6-8 week bounceSo where are we now? Stocks such as BHP and ITUB have indeed broken their October '11 lows. GDOW and many energy related names, such as SU, have yet to break their October '11 lows. Let's take a look at BHP first. A global commodity megacap, it has been leading the market lower. Of the leading stocks that I follow, it has one of the best technical structures. It is currently overbought on the daily chart. I would look for some selling this week, followed by a possible move higher into mid-July to backtest it's broken trendline coming off its November '08 low.

Continue reading "Have We Bottomed For The Summer? (by TnRevolution)" »

At All About Trends, our mantra AT ALL TIMES is “REGARDLESS OF WHAT THE MARKET THROWS AT US”.

After all that is a trait ALL top traders have in common and that is what ALL of you should be striving for vs. getting sucked up in all the Euro hoopla.

When looking at the daily charts, you can see we are hitting some resistance levels. What we want to do is give things a little time to sort themselves out which means PATIENCE with a capital P before we get too cute in any one side of the market here.

Continue reading "The One Trait Top Traders Have In Common" »

Comments

No comments yet.