Browse Symbol Stacks: CAC: Blanks of the trader

Blanks of the trader

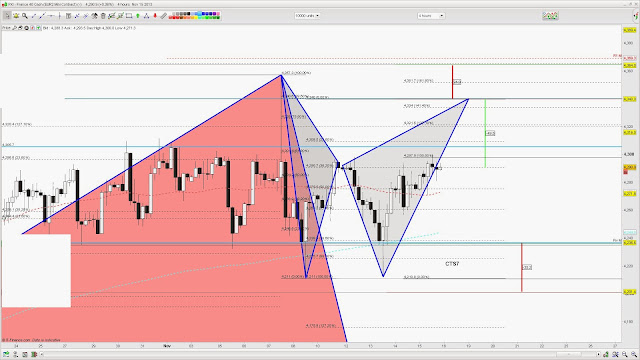

After couple weeks of relatively vague trading setups it seems like we may be heading into something more significant next week. Both setups from last week on CAC40 and GBP/USD did not came into play, the last one becoming invalid when market went opposite direction. CAC40 is the one to watch still, however from much more long term perspective in my book.

Let's kick-of current setups as there are quite some things to cover this week in my portfolio watch list. French CAC40 index formed distinct range between 4240 and 4310's, what looks like matter of time when this range will be broken to either direction. There are two potential setups that may complete next week. Lower barrier of the range @4236's area may present good buying opportunity if will see another test of this area while @4340's is a bit more attractive setup in my book, in terms of shorting this market due to the fact that there is huge potential to the downside move as this market struggled to make new highs recently after multiple attempts.

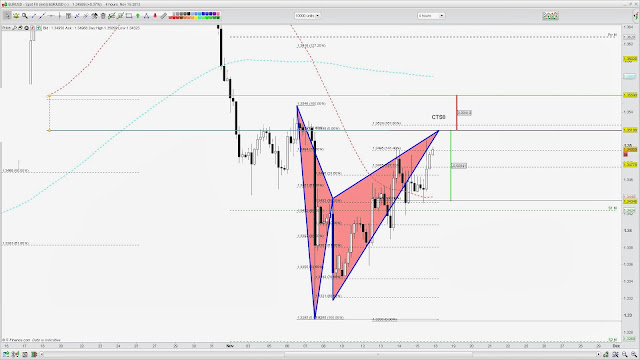

EUR/USD Fx pair came very close to bearish BAT pattern completion last week. We are about 20 pips short of completion at the moment, hopefully will see 1.352's area being tested early next week. Despite recent move to the upside overall bearish mood prevails in the pair at the moment in my book.

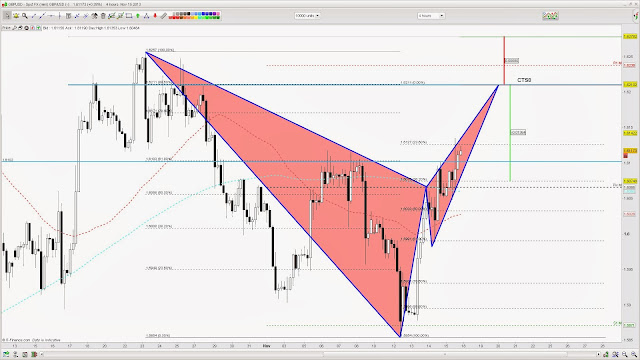

Last but not least is another bearish BAT pattern on GBP/USD Fx pair 4 hours chart. There seem to be some coiling going on if looking at all previous setups. Some USD strength is likely to be the case in coming weeks. Having said that the opposite flow of events has to be considered as there may be surprises in this space. Looking at CALL Options at higher levels would make a lot of sense in this case.

This will sum up this week, have a good one traders!

Comments

No comments yet.