View: Blanks of the trader

Blanks of the trader

Recent fundamental events spiced up markets across the board, providing very good potential setups for the upcoming time before the end of the year. Briefly looking at the last week, EUR/USD setup did not came into play as it seemed that this pair had no intention to have any correction before hitting new highs of 1.38. Perhaps some overall direction of the main instruments became clearer for at least upcoming couple of months before the end of the year, which is clearly reflected by the price action on the charts.

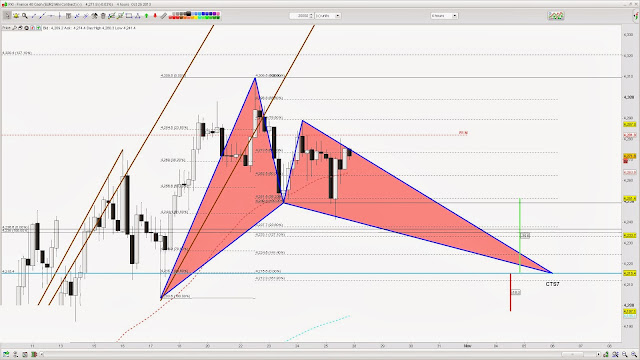

Getting to potential setups, will kick off with CAC40 index that has bullish BAT pattern on a way to be completed @4216 area. As it stands now it is long way before completion, however this market struggled to make new highs over the last week or so, getting into 4216's is likely scenario in my book.

Huge upside on EUR/USD FX pair over last weeks period may have correction from 1.3862's level where the confluence of Pivot,Fibs and AB=CD pattern is about to take place in case this market will have enough steam to get there. Personally i will be looking for this market to stall initially at those levels and then retest it as it is very much counter-trend setup in my book.

Bearish cypher pattern posted couple of weeks ago on GBP/USD market is still in the play as highs of 1.626 were never broken and now there is potential Head and Shoulders pattern to be added to the case of going short on this pair. It is pretty much at the market sell unless we see something dramatic and weekly open will be above 1.626's.

This will sum up this week, have a good one traders!

Comments

No comments yet.