User: Hokie: Hokie's News Articles: Macro Tides: Where Are The Super Heroes? | The Big Picture

Macro Tides: Where Are The Super Heroes? | The Big Picture

Macro Factors and their impact on Monetary Policythe Economy, and Financial MarketsMacroTides.newsletter@gmail.comInvestment letter – May 22, 2012

Macro Factors and their impact on Monetary Policythe Economy, and Financial MarketsMacroTides.newsletter@gmail.comInvestment letter – May 22, 2012

;

Where are the Super Heroes?

In our March letter we discussed the low level of volatility in the stock market, and wondered if the perception that the European debt crisis was contained was correct. We didn’t think so, since the primary factors driving the crisis would continue to deteriorate in 2012. We felt investors would come to realize that Portugal, Spain, and Italy will remain in recession in 2012. The austerity measures have yet to be implemented in each country, and will only weaken demand further when they are. The prospect of a prolonged recession could easily cause interest rates to rise, as global investors conclude these countries debt to GDP ratios will worsen, impaired further by higher funding costs. A classic vicious cycle that has already engulfed Greece and now threatens the European Union. We thought events were fast approaching the tipping point, and said so in our April letter.

Of the 17 countries in the European Union, 12 governments have been voted out of office or collapsed during the last two years. The common denominator in most of the elections has been a combination of factors: unhappiness, anger, despair for those who have been unemployed for too long, and fear that austerity will only make their plight worse. The economic environment is leading voters to vote against incumbents, rather than voting for the challengers with conviction. The newly elected will learn their support is shallow, as voter’s patience fades when economic reports confirm more misery is likely.

Of the 17 countries in the European Union, 12 governments have been voted out of office or collapsed during the last two years. The common denominator in most of the elections has been a combination of factors: unhappiness, anger, despair for those who have been unemployed for too long, and fear that austerity will only make their plight worse. The economic environment is leading voters to vote against incumbents, rather than voting for the challengers with conviction. The newly elected will learn their support is shallow, as voter’s patience fades when economic reports confirm more misery is likely.

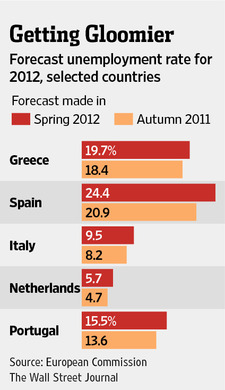

Last November, the European Commission forecast that Euro Zone unemployment would decline from 2011’s average of 10.2%, to 10.1% in 2012. On May 11, the European Commission revised its 2012 forecast and now expects unemployment to average 11.0% this year. Sadly, their guesstimate may be too optimistic. Spain’s unemployment rate was raised from 20.9% to 24.4%, while Greece’s rate was boosted from 18.4% to 19.7%. The unemployment rate for those under age 25 in both countries continues to hover near 50%. These sky high unemployment rates are more reflective of a depression than a recession.

In the 1930’s, people went to the movies to escape from reality. For two hours or more each person could forget their bleak no light at the end of the tunnel existence, with a theatre filled with others caught in the same helpless condition. The collective experience added a measure of comfort. The economic depression in the first half of the 1930’s earned the moniker ‘Great Depression’, not only because of its depth in the United States, but also its global nature. Every major economy was impacted, including Great Britain, France, Germany, Spain and Italy. The path of the U.S. economy during the decade was mirrored around the world. In the mid 1930’s, the U.S. economy mounted a recovery. By the spring of 1937, production and profits had regained their 1929 levels. Unemployment was still high at 14.3%, but down from 25% in 1933. In mid 1937, the economy swooned again and remained in recession through most of 1938. After riding through the depths of the Great Depression, the modest recovery in the mid 1930’s brought a sigh of relief that the worst had past, raising hopes better times were on the way. Those hopes were dashed when the economy fell back into recession. Having hope snatched away, after slugging through the despair of the Great Depression, ushered in a deeper sense of despondency.

Coincidence or not, Superman was born in 1938, when it seemed that our economic future was simply bleak. In 1939, Batman arrived. We now had not one, but two Super Heroes to save the day and right all wrongs, making our world a better place.

In its first week in theatres, the movie “The Avengers” grossed more than $1 billion worldwide, and established an all-time box office record in the U.S. of $207.4 million. The movie features not one or two super heroes, but six: Iron Man, the Incredible Hulk, Thor, Captain America, Hawkeye and Black Widow. The debt deflation facing the United States and other developed countries is a risk on a scale that even six Super Heroes may not be up to the task of managing. Whether movie goers consciously realize their attraction to the “The Avengers” is a manifestation of their present angst, and hope for leadership capable of guiding us out of this economic spiral is doubtful. The global embrace of “The Avengers” tells us all we need to know. The U.S. election in November will also be revealing. Despite its importance, barely 50% of eligible voters will bother to vote. The other 50% will be too occupied watching reality T.V., sports, or updating all their connections on Facebook, letting everyone know what they did last weekend.

In its first week in theatres, the movie “The Avengers” grossed more than $1 billion worldwide, and established an all-time box office record in the U.S. of $207.4 million. The movie features not one or two super heroes, but six: Iron Man, the Incredible Hulk, Thor, Captain America, Hawkeye and Black Widow. The debt deflation facing the United States and other developed countries is a risk on a scale that even six Super Heroes may not be up to the task of managing. Whether movie goers consciously realize their attraction to the “The Avengers” is a manifestation of their present angst, and hope for leadership capable of guiding us out of this economic spiral is doubtful. The global embrace of “The Avengers” tells us all we need to know. The U.S. election in November will also be revealing. Despite its importance, barely 50% of eligible voters will bother to vote. The other 50% will be too occupied watching reality T.V., sports, or updating all their connections on Facebook, letting everyone know what they did last weekend.

Irrespective of who wins the U.S. election in November, one thing will become evident in 2013, in the U.S. and throughout the world. When you need one most, there are no Super Heroes. We will all have to wait for “The Avengers, Part II”, which will likely hit the theatres before 2013 ends.

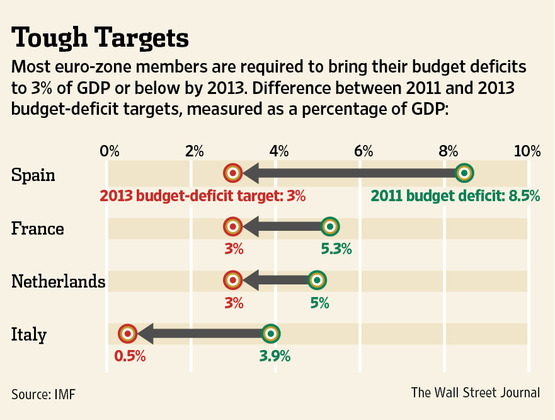

The recent elections in France and Greece have also served as a referendum on the merits of austerity, which were found wanting. Austerity for austerity’s sake is not a solid economic plan, especially for those countries already in recession. Germany may be the biggest paymaster and only adult in the room during E.U. meetings. But insisting on austerity for others, while the German economy is doing relatively well, is beginning to look like bullying. Germany will be forced to soften its position on austerity, and eventually the issue of Euro Bonds. We think Europe will take their foot off the austerity brake, and extend the time frame for a number of countries to reduce their budget deficits to 3% of GDP. While this may help in the short run, it will not address the far larger problem of too little growth and too much debt. Today that is Greece, Spain, Portugal, and Italy. Further down the road, it may include France.

The recent elections in France and Greece have also served as a referendum on the merits of austerity, which were found wanting. Austerity for austerity’s sake is not a solid economic plan, especially for those countries already in recession. Germany may be the biggest paymaster and only adult in the room during E.U. meetings. But insisting on austerity for others, while the German economy is doing relatively well, is beginning to look like bullying. Germany will be forced to soften its position on austerity, and eventually the issue of Euro Bonds. We think Europe will take their foot off the austerity brake, and extend the time frame for a number of countries to reduce their budget deficits to 3% of GDP. While this may help in the short run, it will not address the far larger problem of too little growth and too much debt. Today that is Greece, Spain, Portugal, and Italy. Further down the road, it may include France.

European banks are still highly leveraged, about 25 to 1 based on assets and capital. In order to meet the new Basil III regulatory rules, banks worldwide will need to add $566 billion in reserves by 2019, an increase of 23% from current levels, according to a recent analysis by Fitch Ratings. A reduction in leverage by European banks and the need to increase their Tier 1 common equity before 2019 will reduce credit availability in coming years. As European banks shrink their balance sheets and boost their capital, bank lending will contract. We have no doubt that other global banks with strong balance sheets will pick up some of the lending slack. However, European banks have historically provided 80% of credit to European companies, so Europe is especially dependent on a functioning banking system. The lower supply of credit availability will cause interest rates to rise, so most borrowers in Europe will pay more for the credit they can get. This will have a disproportionate impact on small and medium sized businesses that will not be able to access the capital markets.

S&P has estimated that corporations will need new funding or refinance existing debt totaling $46 trillion by 2016. With global GDP currently just over $70 trillion, this funding will amount to more than 60% of global GDP in the next four years. These corporations will be competing with government funding needs that will approach $65-$70 trillion. The debt service costs associated with the enormous funding needs of governments and corporations is just one reason why growth in the developed nations is likely to remain less than historical averages.

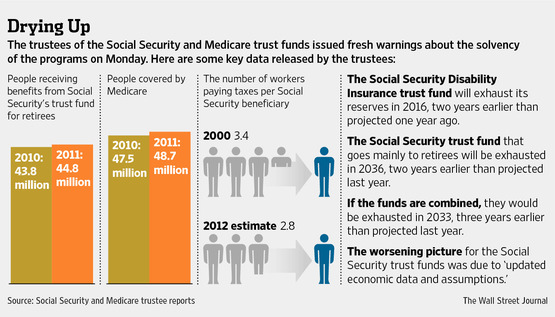

Sub-par growth will make it more difficult for governments to approach anything resembling a balanced budget in the next few years. As tax revenue growth is weak and government spending elevated as safety net programs are maintained and extended, deficits will be the norm. Central bankers in the developed countries will have to offset the deflationary impact from consumer and bank deleveraging, debt forgiveness for over-extended borrowers which concurrently reduces the value of assets for the forgivers, and a reduction in government spending relative to GDP, with an expansive monetary policy that prevents a debt deflationary collapse but does not generate too much inflation. This might be a piece of cake for a group of Super Heroes, but represents a daunting task for mere mortals. What are the odds everything is handled perfectly? The one conclusion we can make is that central bankers will respond to any threat of deflation with more monetary accommodation, since that’s all they can do. We expect more quantitative easing from the Bank of Japan, Federal Reserve, and the ECB. Although the exact timing of when the programs will be implemented cannot be known, they will appear whenever deflation appears to be getting the upper hand.

Managing a financial crisis requires decisiveness and quick implementation. The 17 nation European Union is not equipped to be either decisive or capable of affecting necessary changes in a timely fashion. The European Central Bank has 23 voting members from the member countries, which makes consensus building slow. When the European Union was founded in 1999, no one had the foresight to anticipate the current sovereign debt crisis, or that a country might need to leave the E.U. The European Union does not have regulations to guide them through this crisis, nor the power to enforce any decision. In 2008, the Federal Reserve and Treasury Department were able to respond decisively after Lehman Brothers failed. We criticized the Federal Reserve for being behind the curve in our August 2008 letter. Whether one agrees with Quantitative Easing or not, the Fed’s performance has been far more effective than the ECB’s. Since the Greek sovereign debt crisis first erupted two years ago, the ECB and E.U. have been reactive rather than proactive, responding only when the crisis escalated. This type of crisis management could be disastrous, if Greece leaves the E.U. or Spain is pulled into the vortex of the sovereign debt crisis. A car driver can shift into reverse, but it won’t do much good if the car has just flown off the edge of a cliff. We expect E.U. leaders to downplay the fallout from a Greece exit from the E.U. We wouldn’t attach much credibility to their statements. If there has been one constant the last two years, it has been their underestimating the severity and scope of the sovereign debt as it has continued to fester and spread.

Managing a financial crisis requires decisiveness and quick implementation. The 17 nation European Union is not equipped to be either decisive or capable of affecting necessary changes in a timely fashion. The European Central Bank has 23 voting members from the member countries, which makes consensus building slow. When the European Union was founded in 1999, no one had the foresight to anticipate the current sovereign debt crisis, or that a country might need to leave the E.U. The European Union does not have regulations to guide them through this crisis, nor the power to enforce any decision. In 2008, the Federal Reserve and Treasury Department were able to respond decisively after Lehman Brothers failed. We criticized the Federal Reserve for being behind the curve in our August 2008 letter. Whether one agrees with Quantitative Easing or not, the Fed’s performance has been far more effective than the ECB’s. Since the Greek sovereign debt crisis first erupted two years ago, the ECB and E.U. have been reactive rather than proactive, responding only when the crisis escalated. This type of crisis management could be disastrous, if Greece leaves the E.U. or Spain is pulled into the vortex of the sovereign debt crisis. A car driver can shift into reverse, but it won’t do much good if the car has just flown off the edge of a cliff. We expect E.U. leaders to downplay the fallout from a Greece exit from the E.U. We wouldn’t attach much credibility to their statements. If there has been one constant the last two years, it has been their underestimating the severity and scope of the sovereign debt as it has continued to fester and spread.

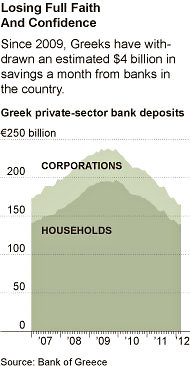

Everyone is familiar with the expression a ‘run on the banks’, especially after 2008 when the FDIC was forced to increase its account insurance limit from $100,000 to $250,000, so depositors wouldn’t pull their money out of failing banks. Depositors in Greek banks have brought a new meaning to that expression, as they have effectively started a ‘run on the country’. This is very serious, and it would be bad if it should spread to the Spanish banks.

Austerity by Another Name, or Entitlement

Austerity: ‘Strict limiting or rationing of food, clothing, fuel, or other commodities to conserve national resources.’ It is noteworthy that the application of austerity to conserve natural resources like food, oil, rubber and water has evolved to now represent the reduction of government spending. We’ve come a long way since World War II, when a nation’s survival depended on conserving natural resources. On April 29, France elected Francois Hollande over Nicholas Sarkozy, who had sided with Angela Merkel and Germany’s adherence to fiscal austerity. Since his victory, Mr. Hollande has said he intends to give Europe “a new direction.” He is demanding that the European Union treaty limiting debt (budget deficits) be expanded to include measures to produce growth. He proclaimed, “Austerity need not be Europe’s fate.”New direction? Politicians the world over have supported government spending in excess of government tax revenue in the name of fostering growth for decades! The irony of Mr. Hollande’s personal revelation is that the government of France is already spending 55.7% of France’s GDP. To prove he isn’t a total profligate, Mr. Hollande has vowed to raise taxes on big corporations, which will do wonders for their global competitiveness. He has pledged to raise the tax rate to 75% for those earning more than $1 million Euros a year. People making that much money and not burdened by a deep sense of national pride, might decide to move to another country, thus lowering France’s tax revenue. No matter. If one believes that any reduction in government spending is a burden too heavy to carry, the only solution is to increase government spending to relieve the suffering.

The Egyptians didn’t build the pyramids upside down for the obvious reason that the narrow pointed top would have been unable to support all the weight. They understood that the base had to be the widest part to support the ‘whole’. After watching the French election, we now know why the pyramids could never be built in France. The 55.7% spending of GDP by the French government is being supported by private sector spending of 44.3%. For every $1.00 of spending by the private sector, the French government spends $1.30. If Mr. Hollande gets his wish, France will be well on its way to building an upside down pyramid that will collapse, hopefully while Mr. Hollande is still in office. Viva la France!

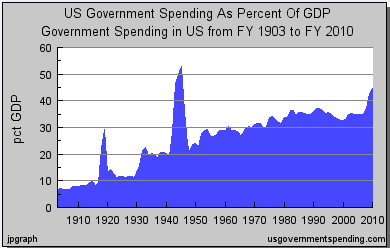

In 1950, total federal, state, and local spending represented 20% of U.S. GDP. The ratio of private sector spending was $4 for every $1 spent by all levels of government. Flash forward 60 years and total government spending is almost 45% of GDP. For every $1 of private sector spending, all levels of government spend $.81. In order for government spending to double from the 20% of GDP in 1950, government spending grew on average 1.2% faster than the economy every year. Unless total government spending grows less than annual GDP, government spending as a percent of GDP will continue to rise. In a couple of decades, we’ll have a pyramid that looks just like France’s, and it will be just as unstable.  However, given the fragility of our current recovery, and the uncertainty in the global economy, we do not think government spending should be slashed in 2013. Instead, the growth in spending should gradually decelerate over the next five years, so that it is rising by less than 2% by 2018, and then maintained at that level until total government spending is no more than 33% of GDP. At that level, private spending will be $2 for every $1 of government spending. The base of that pyramid will be twice as large, and capable of supporting long term economic growth.

However, given the fragility of our current recovery, and the uncertainty in the global economy, we do not think government spending should be slashed in 2013. Instead, the growth in spending should gradually decelerate over the next five years, so that it is rising by less than 2% by 2018, and then maintained at that level until total government spending is no more than 33% of GDP. At that level, private spending will be $2 for every $1 of government spending. The base of that pyramid will be twice as large, and capable of supporting long term economic growth.

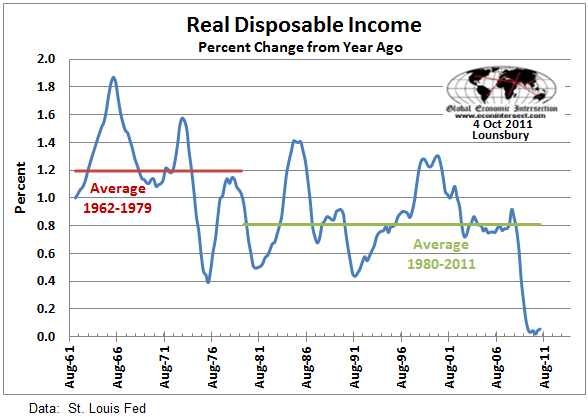

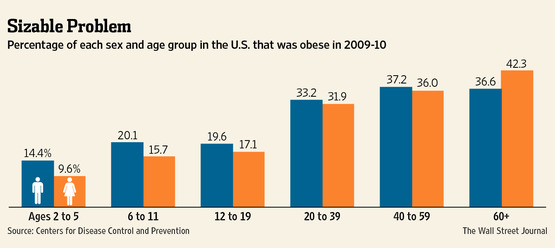

When the ratio of government spending to private sector spending tilts too much in favor of government spending, the private sector is increasingly squeezed by government spending. This is a different kind of austerity. As the private sector shrinks relative to the size of government, job and income growth suffers, causing income inequality to widen. Total government spending exceeded 30% in the 1970’s, which coincidentally, is when inflation adjusted median personal income peaked. Over the last 30 years it has stagnated, and is lower now than in 1973. Ironically, at 18% of personal income, government redistribution of total income has never been higher. Almost half (47%) of all workers pay no federal income taxes, and the top 10% of workers pay 85% of total income taxes. Our income tax code is already fairly progressive.

This is a different kind of austerity. As the private sector shrinks relative to the size of government, job and income growth suffers, causing income inequality to widen. Total government spending exceeded 30% in the 1970’s, which coincidentally, is when inflation adjusted median personal income peaked. Over the last 30 years it has stagnated, and is lower now than in 1973. Ironically, at 18% of personal income, government redistribution of total income has never been higher. Almost half (47%) of all workers pay no federal income taxes, and the top 10% of workers pay 85% of total income taxes. Our income tax code is already fairly progressive.

The median income of the top 300 CEO’s in 2011 was $10.3 million, according to a recent analysis by the Wall Street Journal. We have no problem raising taxes on these folks. It would serve as a symbol for all those who are struggling to make ends meet even though they have a job and work hard. If we follow Mr. Hollande’s lead, and increase their tax rates to 75%, it will generate less than $3 billion in tax revenue. While that might make some people happy, it would only narrow this year’s $1.3 trillion budget deficit by .0023%. We appreciate that the increase in government spending above 33% of GDP isn’t the only factor that has contributed to the stagnation in wages. But philosophically, we find the concept of total government spending representing less than 33% of GDP, or half the size of the private sector compelling.U.S. Economy, Europe, China

The median income of the top 300 CEO’s in 2011 was $10.3 million, according to a recent analysis by the Wall Street Journal. We have no problem raising taxes on these folks. It would serve as a symbol for all those who are struggling to make ends meet even though they have a job and work hard. If we follow Mr. Hollande’s lead, and increase their tax rates to 75%, it will generate less than $3 billion in tax revenue. While that might make some people happy, it would only narrow this year’s $1.3 trillion budget deficit by .0023%. We appreciate that the increase in government spending above 33% of GDP isn’t the only factor that has contributed to the stagnation in wages. But philosophically, we find the concept of total government spending representing less than 33% of GDP, or half the size of the private sector compelling.U.S. Economy, Europe, China

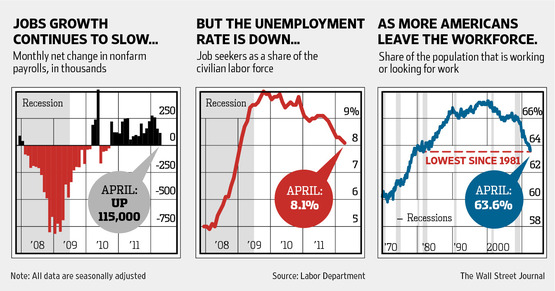

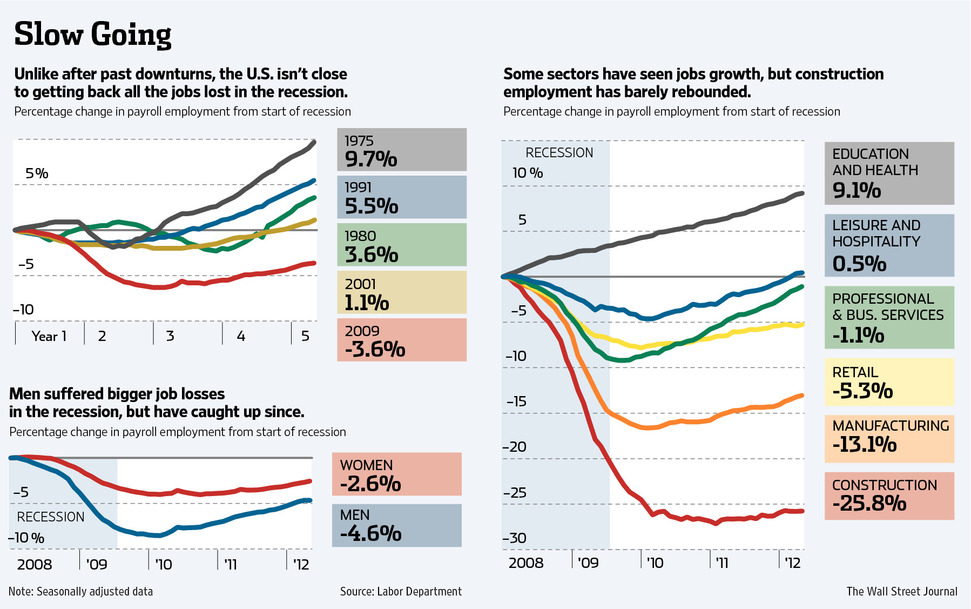

Our view has been the U.S. economy would gradually slow, Europe’s troubles would go from bad to worse, and China would avoid a hard landing. Since everything is unfolding as expected, why bore you with all the details. The charts below tell the story.

U.S.

˜˜˜

˜˜˜

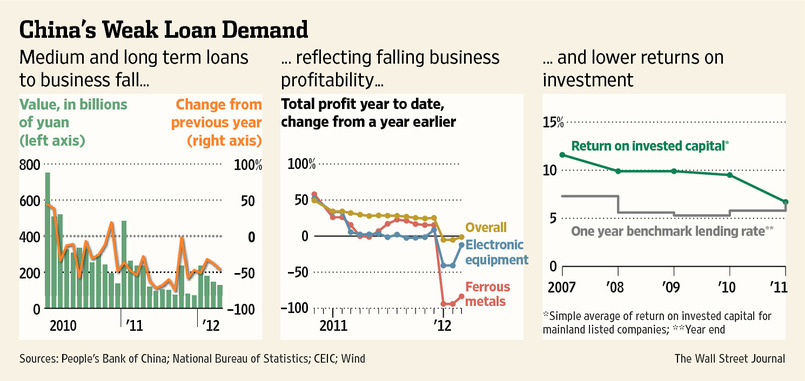

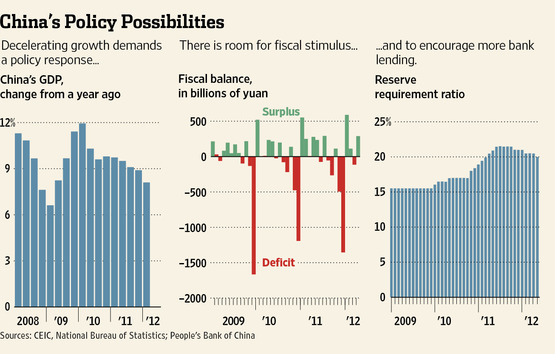

China

˜˜˜

Stocks – As discussed last month, “Sell in May and go away” is an old Wall Street axiom that has gained traction, after working well in 2010 and especially last year. As natural contrarians we would be skeptical of it working for a third year in a row. However, if we’re right about Europe and a slowing U.S. economy, it is likely to work again this year.” The DJIA made a new recovery high on May 1, which was not ‘confirmed’ by any other major average also making a new high with the DJIA creating a divergence. This divergence between the DJIA and the rest of the market has historically been a warning sign, sometimes an important one. We thought the S&P might be able to get above 1,422 and recommended becoming aggressively defensive if it did. Unfortunately, the market was not so accommodating.

Since reaching 13,338 on May 1, the DJIA has peeled off just over 1,000 points. Over the same span, the S&P dropped from 1,415 to 1,292. We think the S&P will fall below 1,292 and test the 200 day average near 1,282 soon. If this occurs before the S&P climbs above 1,358, it will suggest the long term trend of the market has turned down. The market is oversold and sentiment has become fairly defensive. As long as Europe doesn’t blow up in the next few weeks (no sure thing), the market should hold up and attempt to rally for a number of weeks, even if the longer term trend is down. The tricky part going forward is guessing when the Federal Reserve or ECB will choose to launch QE3 or another round of LTRO. The markets will likely enjoy a strong rally on that news, but it will be a fool’s rally. Sooner or later, investors will learn that central bank stimulus is only a short term fix for the stock market, and won’t spur a sustainable economic recovery. When that day comes, the market will be especially vulnerable to a sizable decline. We will cross that bridge if and when we get there.

Bonds – Over the last few months, we recommended buying TLT the 20-year Treasury ETF. The average price was $114.66. Our expectation has been that it would exceed its October 4 high of $125.03 before year end. It traded as high as $124.45 on May 21. Sell half if it trades above $124.45, and raise the top to $119.49.

Dollar – Last month we said, “When Europe heats up, so will the Dollar”. And so it has. Raise the stop to $22.00. We still believe the Dollar index will approach 89.00 over the next year.

Gold - For months we have felt Gold would decline to $1,525 – $1,550. Last week, Gold dropped to $1,527, which may have completed a triangle pattern from last September’s high above $1,900. We would recommend establishing a 50% position in Gold via the ETF GLD on weakness, which is priced as 10% of Gold. We would use a stop of $147.50. If Gold breaks below $1,500, it would likely suggest a systemic liquidity problem like last year, or selling by the European banks, since they may need to sell Gold to shore up their balance sheets.

Macro Tides

Comments

No comments yet.