Browse Symbol Stacks: AUDUSD: Blanks of the trader

Blanks of the trader

AUD/USD setup posted last week got completed last week @0.9386 and stopped me out for about -35 pips net, having said that traders with wider stops may be still in position to take advantage from this setup, as the price action stalled @0.9440's level before diving south at least temporarily. This week has at least one so called "premium risk event", as FOMC meeting on Wednesday is likely to create more significant moves across the board of major assets. British currency GBP seem to be strongest one across the board for coming months as last weeks fundamental GDP and employment data was inline with projections of BOE raising interest rates rates this year, so watch this space.

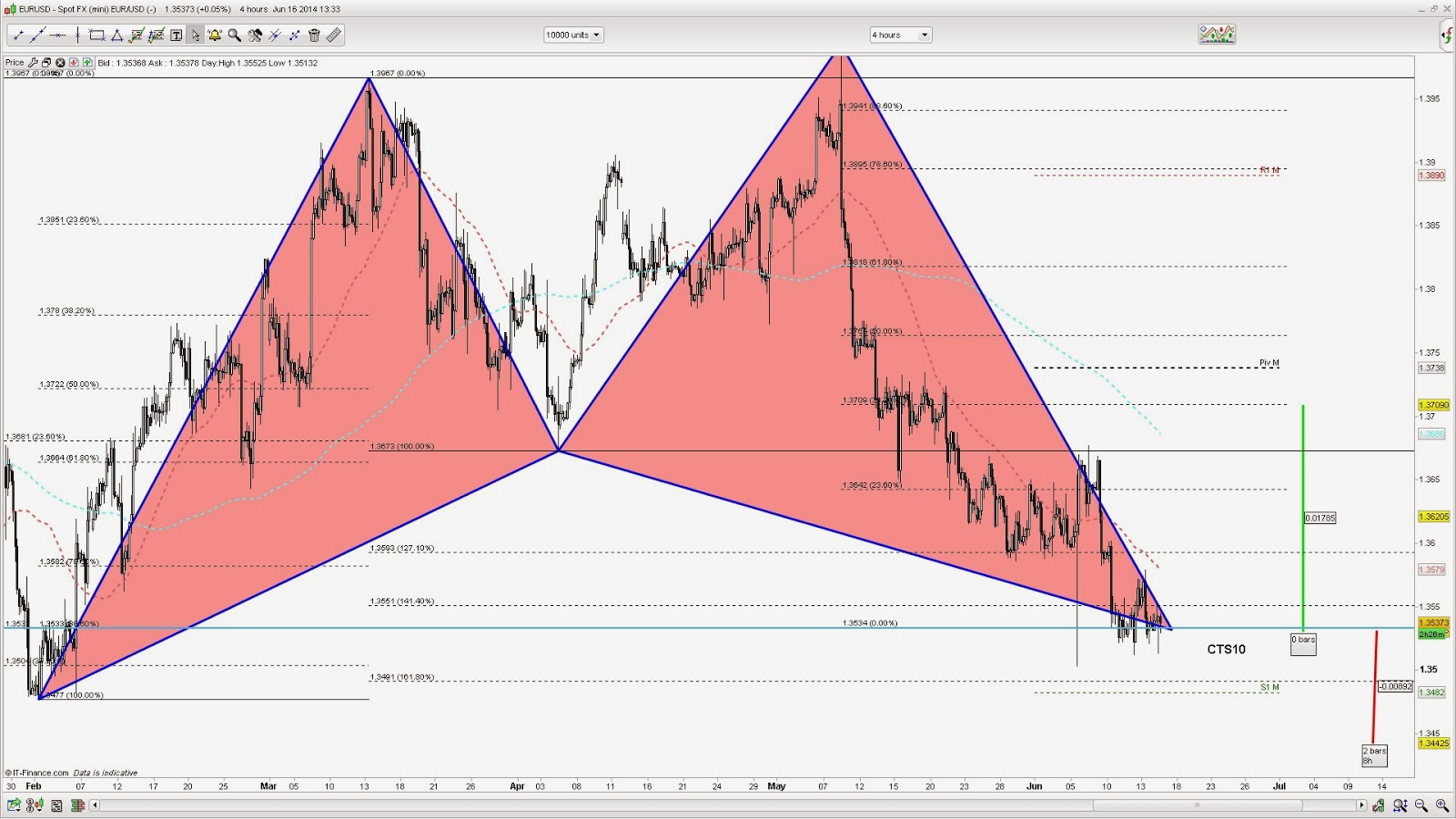

Risk events (UK time) Tuesday UK CPI (May), 9.30am: UK price growth is expected to ease to 1.7% year-on-year and 0.1% month-on-month from 1.8% and 0.4% last month.Market to watch: GBP/USD, EUR/GBPGerman ZEW (June), 10am: The current situation survey from the ZEW index is not forecast to change this month, remaining at 62.1.Market to watch:DAX, EUR/USDUS CPI, housing starts, building permits (May), 1.30pm: The plethora of US data is forecast to see month-on-month price growth of 0.2% and year-on-year of 1.9%, both slightly weaker, while housing starts are expected to weaken to an annual rate of 1.033 million from 1.072 million last month. Building permits will decline to an annual rate of 1.07 million from 1.08 million. Market to watch: Dow Jones, S&P 500, US dollar crosses Wednesday Japan trade balance (May), 0.50am: Japan’s economy is heavily dependent on exports, and the gap between imports and exports is expected to widen to Y1183 billion from Y811.7 billion.Market to watch: Nikkei 225, USD/JPYBank of England minutes (June), 9.30am: Given Mark Carney’s comments at the Mansion House, these minutes may be more interesting than previous iterations.Market to watch: GBP/USD, EUR/GBPFederal Open Market Committee meeting (June), 7pm: There is no change expected in the US interest rate or in the rate of tapering, with another $10 billion cut from QE, bringing it to $35 billion.Market to watch: Dow Jones, S&P 500, US dollar crosses, other major global indices Thursday UK retail sales (May), 9.30am: Consumer spending in the UK is expected to weaken by 0.8% in May, from growth of 1.8% month-on-month in April. Year-on-year growth is forecast to drop to 4.8% from 7.7%.Market to watch: GBP/USD, EUR/GBPUS initial jobless claims, 1.30pm: After a 317K print last week, 315K is expected. Market to watch: Dow Jones, S&P 500, US dollar crossesPhiladelphia Federal Reserve index (June), 3pm: This business outlook index, which is usually quite volatile, is forecast to fall to 14 from 15.4 a month earlier.Market to watch: Dow Jones, S&P 500, US dollar crosses Friday German PPI (May), 7am: The week ends relatively quietly with a reading on German producer prices. The month-on-month figure is expected to be 0%, up from -0.1% in April, while year-on-year prices are forecast to shrink by 0.7%, from a drop of 0.9% a month earlier.Market to watch: EUR/USD,DAX EUR/USDThe more the story unwinds around single EUR currency, the more conviction across the board is that it is not meant to be weak at all, so fundamentally downside seem to be limited, however technically the market is in downtrend on longer time-frames. The BAT pattern that got completed last week @1.3535's is pretty much at the same level as it stands now. There is about 90 pips of risk to be taken on-board in order to be protected from directionless volatility blips that can squeeze position out. To sum up it is counter-trend BUY, see the chart below.

CAC40Fundamentally long position on this instrument seem to be out of line with mainstream bias of upcoming correction, however technically we have bullish Cypher pattern on 4 hour chart in sideways consolidation. There is at least 50 pips of risk to be taken on-board with this BUY signal.

Comments

No comments yet.