Browse Symbol Stacks: EURUSD: Blanks of the trader

Blanks of the trader

Massive move up on GBP/USD pair got Shark pattern completed in the midweek. Despite initial move south prevailing strength of GBP across the board allowed to exit this position in an early manner cutting about 50% of originally anticipated maximum loss. Bearish BAT pattern on EUR/USD posted last week is still valid, however relatively sloppy price action on that pair did not make completion of this pattern any closer. Coming week interest rates announcements across major currencies likely to be main drivers of any potential moves, any deviation from earlier anticipated numbers can spark some fireworks. In terms of markets i will be watching next week will be adding two new instruments that came into ranges matching my current risk profile. Namely GOLD (XAUUSD) and CHINA A50 index are added to my watch list. Due to the lack of current setups in other instruments this stub will focus on those two new markets.

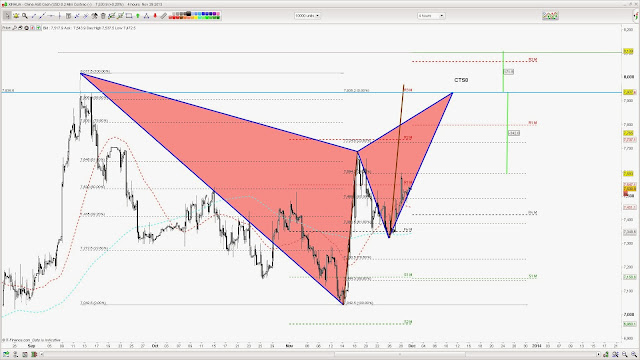

CHINA A50(XINHUA) is currently in early stages of completing bearish Gartleys pattern. If completed will be looking to sell 7935's area. R multiple on this setup looks particularly attractive. Having said that this is very much counter trend setup in my book, therefore it makes sense to adjust the size of the entry accordingly.

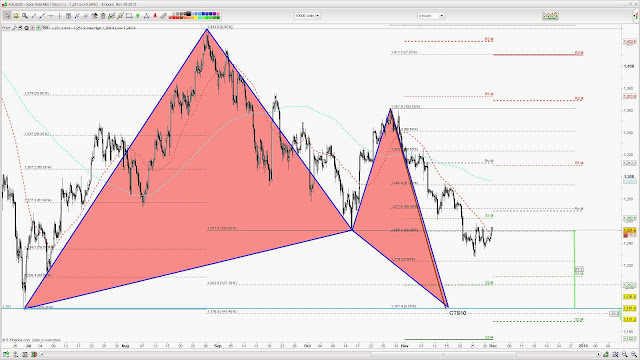

Another Gartleys pattern can potentially complete on GOLD (XAUUSD) @1181's level. After very volatile start of this year this market came into tradable range where more traders can be involved in. What i like about this very deep Gartleys pattern that completes close to X point of initial impulse move is risk/reward multiple ratio. On a caution note this is very much setup against current prevailing downtrend, therefore despite initial pullback north is very likely, much more stronger buying has to come to make it more sustainable move.

Have a good one traders!

Comments

No comments yet.