View: A Deeper Examination of the Analog | Slope of Hope

A Deeper Examination of the Analog | Slope of Hope

Tim

Moments ago, I published a new post with an important analog of the Russell 2000. I wanted to give my Slope+ readers something extra.

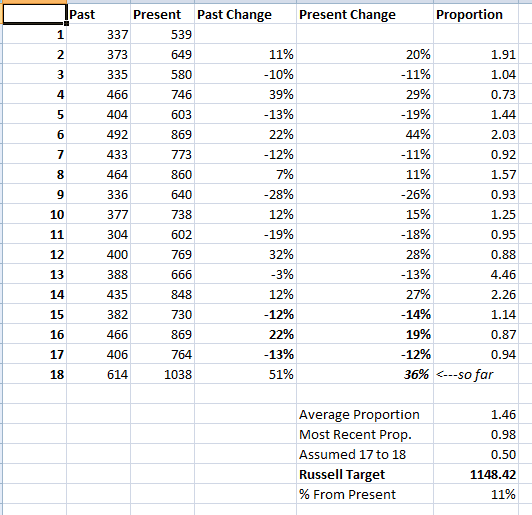

What I did was record the whole number value of the Russell data, point by data point, and calculated the percentage change between each point. I did this both for the late 1990s chart as well as the present chart.

I then calculated the propotion of the present change to the past to get a sense as to the scale of present price movement versus that which was experienced in the 1990s. A lot of the data point moves are over very short timespans, but I did this out of curiousity more than anything else, since I was most interested in just the most recent propotionate changes.

These were all pretty close (1.14, 0.87, and .94), averaging to a figure of 0.98. Thus, given that the final move from #17 to #18 was 51%, the pro-rated move in the current #17 to #18 is just a little less, 50%. I reached a projected figure of about 1148 on the Russell, which is a full 11% higher from here.

Naturally, I was disappointed, because it would have been exciting to see that a reversal was close at hand. But the market has, historically, not based its price movements on what I find to be exciting, so I need to take this figure at face value. What deepened my conviction about this disturbing conclusion was a chart I made, which shows how a move to this level would correspond beautifully to a major trendline.

This projection also puts the top rather far out in the future – like late September or early October of this year. So, being the impatient sort, I was doubly disappointed seeing a projected gain of 11% more which wouldn’t be complete for two or three months.

I think it’s more important to recognize that we’re in the final stage than to try to pinpoint when and at what level things will end. I think I’m going to brace myself for a final rocket-ship thrust of this market, however, because I think we are in a similar place as the world was in January 2000 – - that is, still in an ascending market, but unwittingly close to the beginning of a multi-year plunge.

Comments

No comments yet.