Source: slopeofhope: ES Quantitative Analysis SHORT | Slope of Hope

ES Quantitative Analysis SHORT | Slope of Hope

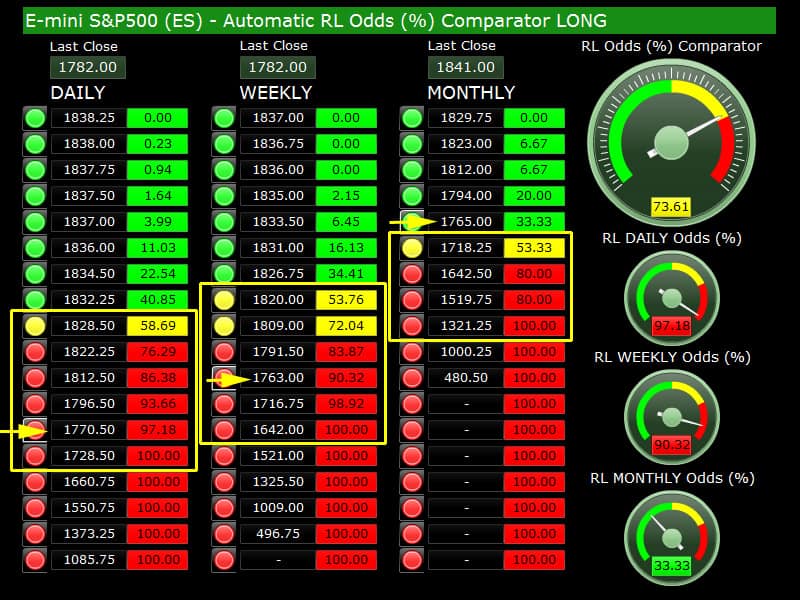

Futures are rising at the moment of writing, and yesterday the ES reached VERY oversold levels according to our PRICE STRETCH and TIME STRETCH measurements: 1767 was the low of the day, just below our 1770 level with 97.18% odds (see below). 3 days down in a row and also this is the 3rd week down in a row.

The Weekly time period as well was quite oversold, so all this means a bounce is imminent and probably has already started from yesterday at 1767 and will continue today into a positive Daily Close.

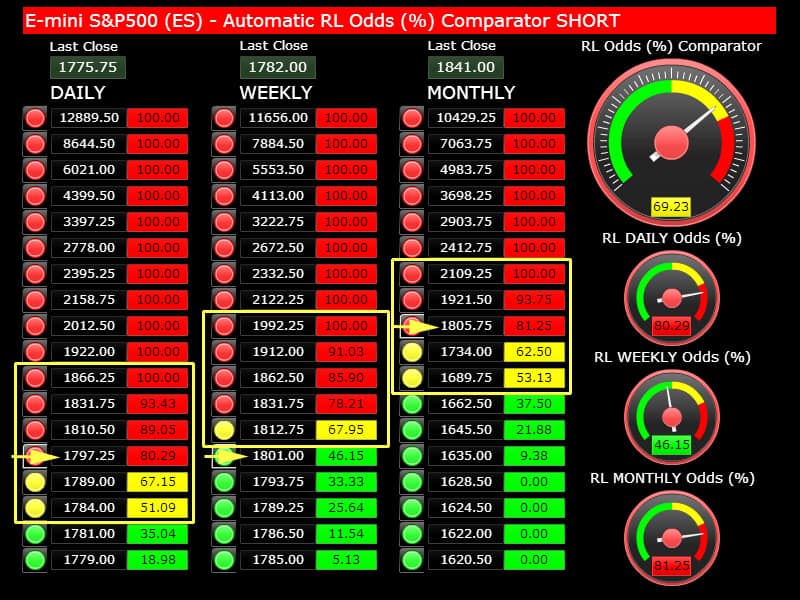

Next, for the joy of all Bears, the recommended price levels to go SHORT on this bounce: if the market has started a downtrend, you want to short the rallies and you want to do that earlier rather than later, i.e. level with lower odds can work well in a short-the-rally context.

We would anyway wait a bit, to give the market some room to rise: 1797.25 would be the first place where we would put our SHORT bets. 80.29% odds, excellent odds.

At the moment of writing the market has already reached and breached the 1784 level with 51.09% odds. This level can be tried as well, but if there is a bounce today it is probably going to go higher than 1784. 1797 is probably a safer bet.

Pay attention to something: this week is the 3rd week down in a row and if this week closes down (we still don’t know), the TIME STRETCH indicator LONG would start to flash good odds to go LONG. What does it mean? It means that this week may be the last one down, or in another words the Bear Party may be soon over and the next week will see higher price. We will re-evaluate this scenario at the end of the week.

Comments

No comments yet.