View: The Future Tense

The Future Tense

I have been reading more and more from those that were previously bearish on housing who have now become bullish and are putting in their "bottom calls." I will get that to that in a moment, but let's begin with the data.

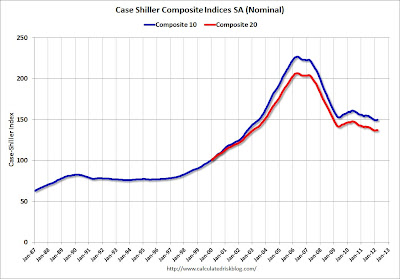

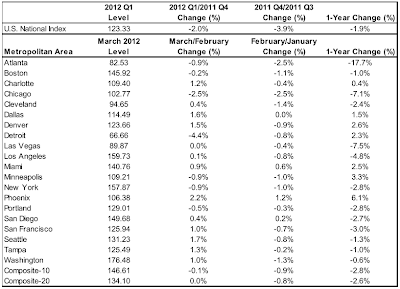

This morning we received the Case-Shiller real estate prices for the month of March, which showed all three composites touching new post bubble lows (from the peak in 2006). The national composite was down 2% in the first quarter.

Earlier in the month we received housing permits, starts, and completions (the natural three step process real estate moves through in order to come out of the ground). While almost all the current activity is focused on the multifamily portion of residential real estate, you can see in each of the charts below that we are still in multi-decade troughs in terms of activity.

Housing Permits:

Housing Starts:Housing Completions:At the bottom of each of the graphs above, you'll notice that the data has turned up slightly from the lows. This has led to market observers "putting in the bottom" for real estate prices. Under a normal boom/bust cycle this would be correct, but as I have discussed many times in the past, this was no ordinary cycle.

Housing still faces enormous headwinds in the months ahead in the form of underwater mortgages, shadow inventory, rising interest rates, demographic trends, and a struggling jobs market.

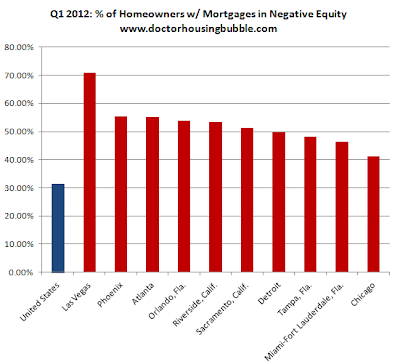

We'll begin first with the underwater mortgages. The following graph shows the total percentage of underwater mortgages in the United States (far left blue line), which has crossed over 30%. It is incredible to think that almost 1 out of every 3 mortgages in America is drowning.

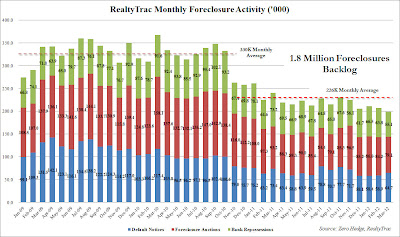

The shadow inventory is the category I believe is fooling some of the recent bottom callers. When the robo-signing scandal was completed at the start of this year it was assumed that the backlog in homes held off the market would begin to make their way into the inventory supply.

This has not yet happenedas seen in the graph below. This inventory, which continues to be held off the market, has created an artificial supply squeeze in many markets. This will change when the dam breaks.

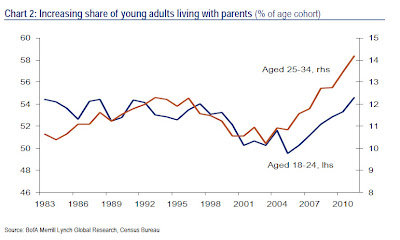

To compound these issues, there is the larger and larger percentage of the youth in America that are moving in with their parents. These younger students that finish college with tens of thousands in student loan debts needing to be paid every month now have far less money to put toward either a monthly payment or a down payment (even with the government's ridiculous 3% down loans). It will take a "cleansing" of this debt (tax payer funded bailout) from a politician looking to get elected, perhaps as early as this fall, that will provide the boost needed to get these younger Americans into homes (or coffins - as they are referred to these days).

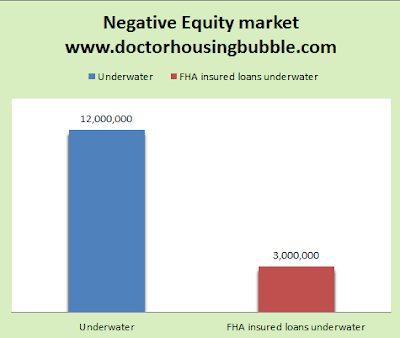

Speaking of homes underwater, there are currently over 12 million underwater homes, but there has been a recent change into what type of loans make up this toxic debt pool. In the graph below you see the new entrant to the party, government (tax payer) backed

FHA loans which now make up close to 25% of the total and rising fast.This has created a surge in FHA delinquencies, and they will soon either need a bailout or they will be forced to create much stricter lending standards -

meaning less potential homeowners will qualify for a loan.

We are much closer to the bottom for real estate prices than we are to the top, however, I believe there will more pain ahead before we find that bottom. The speed at which we reach the bottom will depend on how soon the shadow inventory enters the market and how long the government can continue to fund subprime loans.

The following chart shows month over month and year over year changes city by city. The price declines in Atlanta are staggering (click for larger image).

For much more on the outlook for residential housing see

2012 Outlook: Residential Real Estate.

h/t Calculated Risk, The Big Picture, Dr Housing Bubble, Zero Hedge, The Chart Store

Comments

scrow774

scrow774

+Case+Shiller+March+2012.jpg)

+housing+permits+march+2012.gif)

+Housing+Starts+March+2012.gif)

+Housing+Completions+March+2012.gif)

+negative+equity+by+state+and+country.png)

+realty+trac+foreclosure+activity+march+2012.jpg)

+increasing+share+of+youth+living+with+parents.jpg)

+loans+underwater+vs+fha+loans+underwater.png)

+yoy+price+changes+by+city.png)