Date: June 2012: The Oil Drum | Tech Talk - The Potential for Saudi EOR

The Oil Drum | Tech Talk - The Potential for Saudi EOR

Posted by Heading Out on June 3, 2012 - 9:55amTopic: Supply/ProductionTags: aramco, co2 science, crude oil production, eor, ghawar, saudi arabia, smartwater, tar sands [list all tags]

Without getting into the discussion of the other aspects of the site, it was interesting to read a post dealing with future oil production on “Watts Up with That” today, in which it is suggested that the forthcoming fall in Saudi oil production will presage the decline in overall global oil production. (The site has won the “Best Science” weblog award the past two years).

The relevant quote is

The next big one to tip over into decline will be Saudi Arabia.

And, if you have been following this series, then you will understand the basis on which I make the observation that this is, in fact, incorrect. The site uses a plot by Euan (without the link) from back in 2007, though it is credited to 2008.

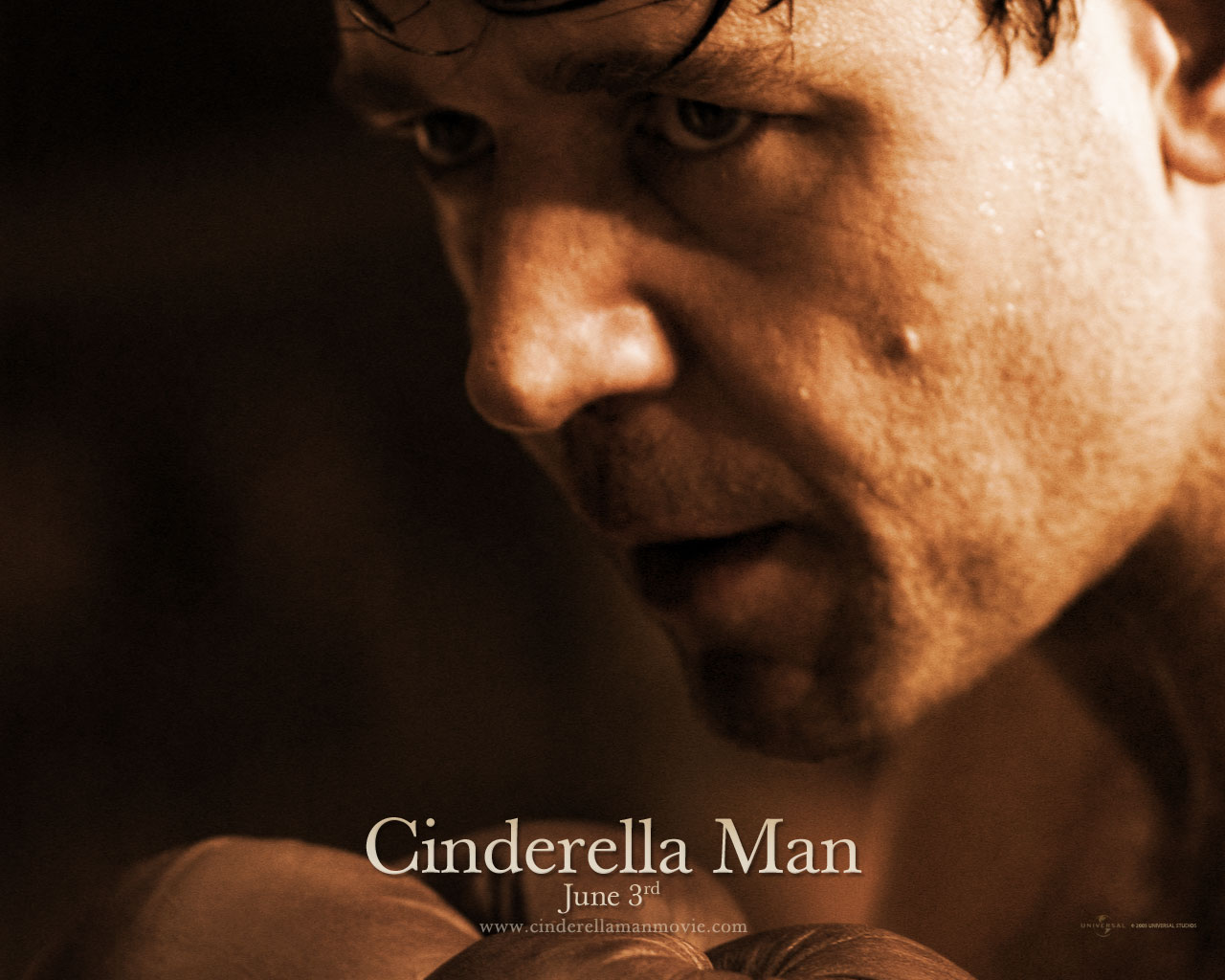

Figure 1, Euan’s production estimates from 2007.

Figure 1, Euan’s production estimates from 2007.One of the reasons that I am writing the current OGPSS series is to see how the earlier estimates that we made “back when” are playing out, and for reasons I have explained both in earlier posts and below, Saudi Arabia is likely still a couple of years away from peaking. No - to finish the opening thought - the major player who will tip over first is much more likely to be Russia (of which I have written earlier) than the Kingdom of Saudi Arabia (KSA). Very simply, Russian producers will likely yield back global production leadership to the KSA soon, (though presently still slightly ahead). Further, since they run on maximizing current production rather than overall field yield, they are not doing the necessary steps to sustain future production, a growing characteristic of the KSA operations.

There are a number of different examples to illustrate this, as I have documented earlier. In addition the KSA seems increasingly interested in developing the enhanced oil recovery (EOR) techniques that have helped other fields in the latter stages of their lives.

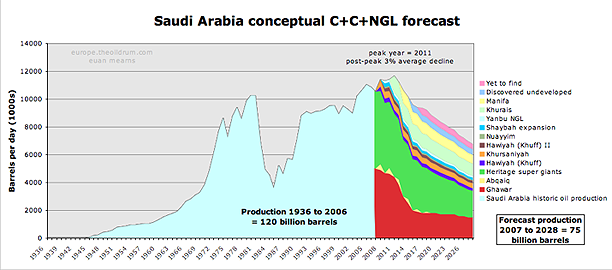

Figure 2. Enhanced Oil Recovery methods and production volumes (Saudi Aramco)

Figure 2. Enhanced Oil Recovery methods and production volumes (Saudi Aramco)As Aramco note, as the price of oil has risen, so the economic viability of EOR technologies covers a greater range of options.

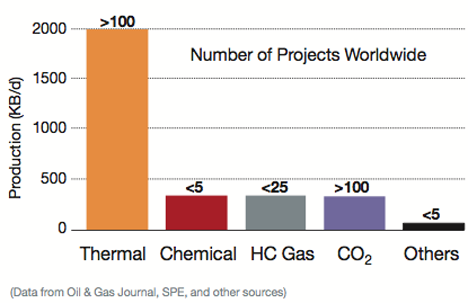

Figure 3. Comparative volumes of oil available as the price (in 2008 US$) rises (Saudi Aramco)

Figure 3. Comparative volumes of oil available as the price (in 2008 US$) rises (Saudi Aramco)Traditional CO2 injection, for example, can enhance overall field production by perhaps 18% or more.

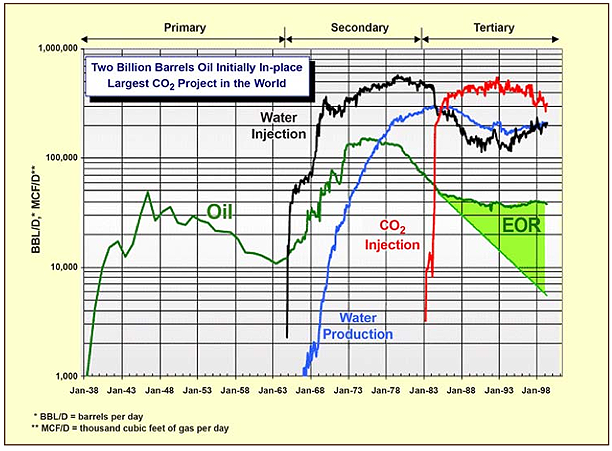

Figure 4. Traditional use of CO2 for EOR (DOE)

Figure 4. Traditional use of CO2 for EOR (DOE)DOE notes

In WAG injection, water/CO2 injection ratios have ranged from 0.5 to 4.0 volumes of water per volume of CO2 at reservoir conditions. The sizes of the alternate slugs range from 0.1 percent to 2 percent of the reservoir pore volume. Cumulative injected CO2 volumes vary, but typically range between 15 and 30 percent of the hydrocarbon pore volume of the reservoir. Historically, the focus in CO2 enhanced oil recovery is to minimize the amount of CO2 that must be injected per incremental barrel of oil recovered, especially since CO2 injection is expensive. However, if carbon sequestration becomes a driver for CO2 EOR projects, the economics may begin to favor injecting larger volumes of CO2 per barrel of oil recovered, i.e., if the cost of the CO2 is low enough.

And how effective can it be? Consider this plot of production gains in the Wasson field in West Texas.

Figure 5. Production gains from the injection of CO2 in the Wasson field of West Texas (DOE)

Figure 5. Production gains from the injection of CO2 in the Wasson field of West Texas (DOE)Note that the DOE reported that in 2008 the industry was injecting 1.6 bcfd (billion cubic ft/day) into Permian Basin fields to produce 170 kbd of oil.

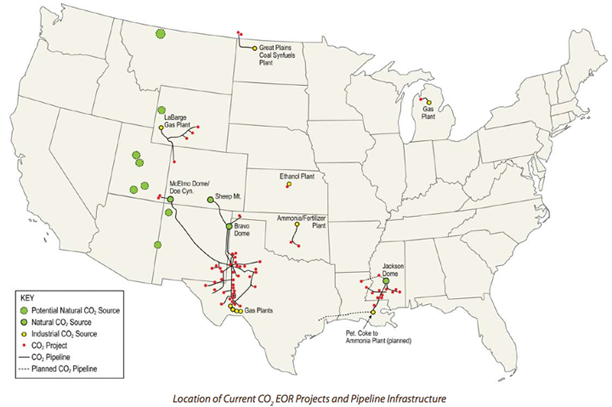

Figure 6. Sites of US Co2 injection projects as reported in 2010 (DOE )

Figure 6. Sites of US Co2 injection projects as reported in 2010 (DOE )It is worth noting that the KSA initial site is being set up to inject 40 mcf/d (million cubic ft/day) some 2.5% of the US volume, into 7 wells in the initial pilot project, in Uthmaniyah so that the initial gain in KSA production may well be quite small, but there are additional CO2 sources in country which, should the pilot show to the gains potentially possible, can be tapped and which could significantly change the overall ultimate recovery of oil from Ghawar (and others). Further there is ongoing research into enhancing the performance of CO2 in EOR, that will likely pay off in the medium term.

In regard to the SmartWater flooding the first field injections have been successful, and a full scale demonstration is now planned. The advantages for this change are considered to be:

• It can achieve higher ultimate oil recovery with minimal investment in current operations (this assumes that a water- flooding infrastructure is already in place). The advantage lies in avoiding extensive capital investment associated with conventional EOR methods, such as expenditure on new infrastructure and plants needed for injectants, new injection facilities, production and monitoring wells, changes in tubing and casing, for example:

• It can be applied during the early life cycle of the reservoir, unlike EOR.

• The payback is faster, even with small incremental oil recovery.

A BP study (Lager, A., Webb, K.J. and Black, J.J.: “Impact of Brine Chemistry on Oil Recovery,” Paper A24, presented at the EAGE IOR Symposium, Cairo, Egypt, April 22-24, 2007. Also Strand, S., Austad, T., Puntervold, T., Høgnesen, E.J., Olsen. M. and Barstad, S.M.: “Smart Water for Oil Recovery from Fractured Limestone: A Preliminary Study,”) showed the following incremental gains over conventional water flooding.

Figure 7. Gains achieved by BP in changing salinity in recovery from different fields (Saudi Aramco).

Figure 7. Gains achieved by BP in changing salinity in recovery from different fields (Saudi Aramco).The current areas of investigation have extended into dealing with the tar mats that are present in parts of Ghawar.

Figure 8. A core of tar-bearing carbonate rock under attack by hydrochloric acid (Aramco Journal of Technology)

Figure 8. A core of tar-bearing carbonate rock under attack by hydrochloric acid (Aramco Journal of Technology)Current research is aimed at extending wormholes into the formation, through which it will be possible to pass different EOR treatments in order to further improve the extraction rate from the field.

When these current projects, in their various stages, are combined with the future production from Manifa, and enhanced production from Safaniyah, I expect that the Kingdom will continue to produce at around 10 mbd for at least a few years more, though I continue to doubt that it will be able to increase much beyond that. After all, even when field declines are held to 2% a year, after 50 years the arithmetic starts to take an increasing toll – Ghawar began production in 1951.

And so, with respect, I disagree with David Archibald, if only in the short term - but for those of you with a few minutes, the comments that follow his post at WUWT are quite entertaining.

Comments

No comments yet.