View: Blanks of the trader

Blanks of the trader

It is amazing how fast things are changing on the markets, even comparing to the last week when there were no real opportunities looking ahead, both early setups posted became invalid almost immediately. This weeks stub present opportunities in every market in my watch list, so there will be no shortage of setups for coming week to take advantage of if opportunities will present themselves. Having said that not every setup is valid trade entry, so be aware of one of the major traders sins - overtrading. Anyway looking at the charts the situation looks much better then last week. Lots of different type of activities are going on approaching the month of May, some long term market players are covering positions, others are entering, presenting good swing opportunities in a meantime.

First in my list is French CAC40 index. Very appealing down trend continuation setup on 4 hour chart. Will be looking to short 3658's area and see if the bottom part of the channel will resist downside pressure that is coming from prevailing trend.

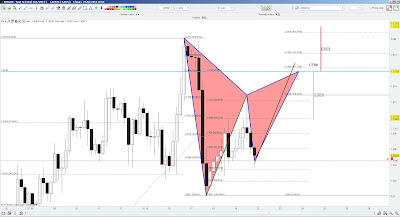

EUR/USD FX pair may have at least two setups completing next week. The immediate one is H&S pattern that is 90% completed at this point, will be important to see where this market will open after the weekend. Having said that more than 100 pips of risk have to taken on board, which makes it less attractive from risk management standpoint. In case of this pair shooting north 1.3159's is the level where bearish Gartleys pattern will complete. Risk/reward on this setup is close to 1:1 for target 1, again perhaps opportunity not for everyone.

USD/JPY pair is getting very close 100 level, where AB=CD pattern completes together with Gartleys. Having said that Fibonacci ratios on this 4 hours bearish Garlteys are not ideal. This pair has shown some hesitancy continuing north if will see any correction or even reversal, very likely to happen from this level. Will be looking to sell 99.90's area to get involved with this setup.

Finally Gold (XAUUSD) had very good moves recently. The issue is that candle ranges expanded almost twice during the last 2 weeks. The stops that this market requires to have are pretty much out of the range for lots of traders, so despite there are opportunities there only big boys can afford to get involved with this instrument at the moment. In the chart below there is channel trade opportunity, if market comes back to 1392's will likely to see 1425 on the other side of the spectrum of this range.

This will sum up this week. Have a good one traders!

Comments

No comments yet.