Last week we highlighted the fact that the market is reaching VERY OVERBOUGHT levels on DAILY and WEEKLY time periods (not yet MONTHLY though, which means higher prices are possible after the upcoming DAILY+WEEKLY pullback).

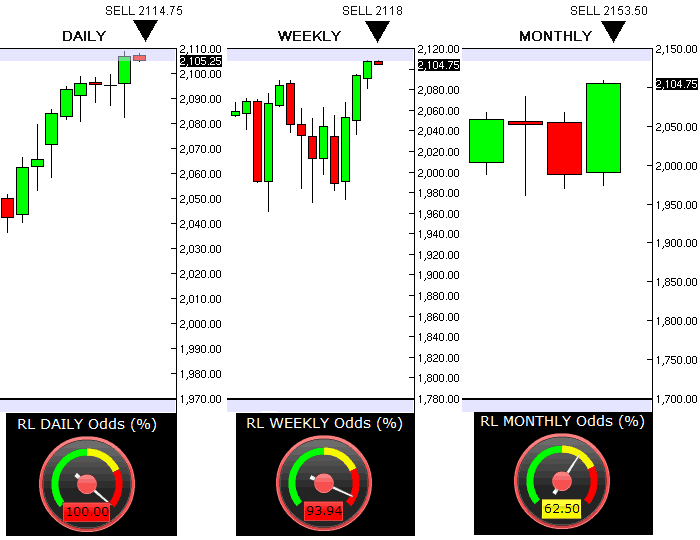

Last week had a strong positive Close, but nothing happened from the point of view of our suggested SHORT trade, it’s still there, as you can see from this chart below, the market is really OVERBOUGHT at these levels:

>> Click here if you want to receive this analysis every day in your inbox.

We know that many slopers are trading really short-term for a point or two, and can’t play these trades across 20-30 points ranges and so we wanted to let you know that we have also a model that works on HOURLY time periods and tries to help the trader scalp away a few points. If you are interested in this product, please enquire by email through Tim Knight or directly to us, as we do not have a direct link signup for this product.

If you are a longer term trader, we just wanted to point out for you that the very good SHORT setup presented last week is still valid, and even better and we expect a DAILY+WEEKLY correction that may bring the index down by 50 points. After that the market should be a BUY again, but we will re-update our forecast in the next few weeks.

Here below is a summary of the current SHORT levels and related overbought degrees:

>> Click here if you want to receive this analysis every day in your inbox.