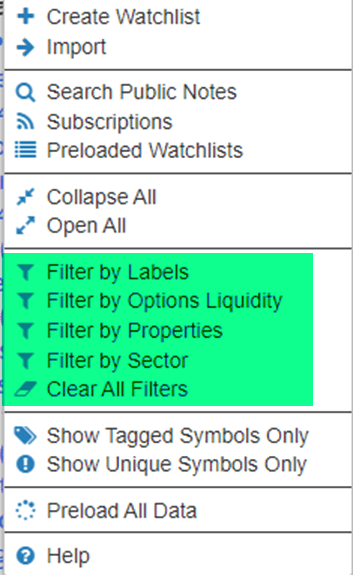

If you want to limit the symbols displayed in your watch lists or your sectors list, you can do so easily with the Filters menu items. The data panel, on the left side of SlopeCharts, can show many kinds of information, but the four styles of filters available on the Watch Lists menu can save you time by stripping away items in which you have no interest.

There are four different filtering tools, described below. You can also wipe out every single filter being used by choosing the Clear All Filters menu item.

The first method, Filter by Labels, has a full feature set unto itself, and you can learn about this feature by clicking on this link to see its dedicated page.

The second method, Filter by Options Liquidity, is a special feature for Gold and Platinum members.

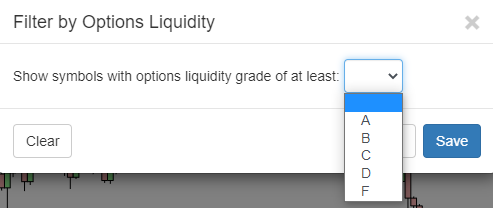

When you are looking for options opportunities, the bid/ask spread for many options can be absolutely awful. Therefore, what we’ve done is created an examination process on our data feed to look at the volume and open interest of all options data and give each stock a grade from A (very liquid, easy to trade) all the way to F (terrible). That way, if you want to only look at stocks with, let’s say, an A or B grade, I won’t waste time with all the garbage.

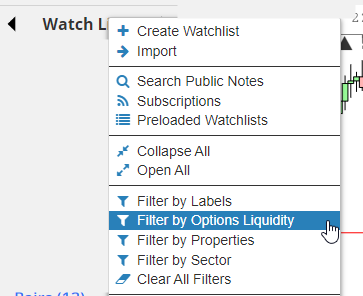

To use this, all you do is bring up the Watch Lists menu, and you’ll see this new entry.

This brings up a dialog box, and you just choose the minimum grade that you’ll want to see.

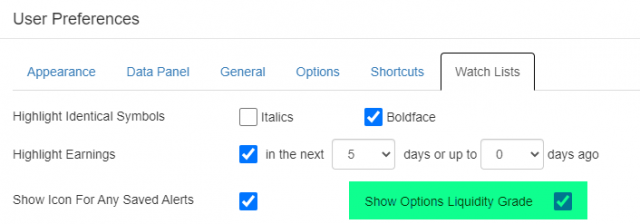

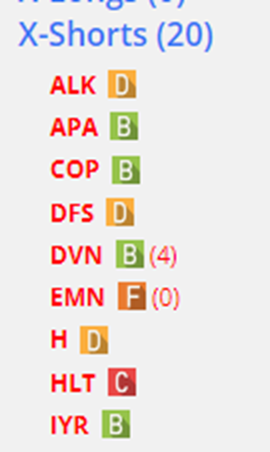

SlopeCharts has gone a step farther with this by also having a Preferences checkbox which lets you explicitly show the liquidity grade next to each symbol in brackets. This gives you an instant way to see which symbols have what grades.

If you use this feature, a uniquely-colored icon with a grade will appear next to each symbol that has options, ranging from A (highly liquid, easy to trade) to F (very poor quality options, typically with very large bid/ask spreads).

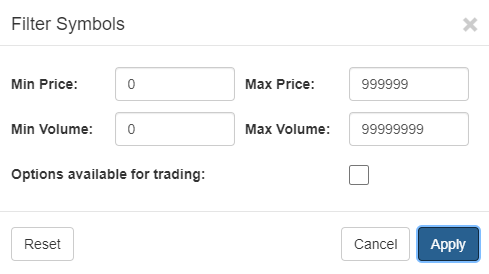

With the third method, Filter by Properties, you can set a minimum price, maximum price, minimum volume, and maximum volume, in order to restrict the symbols displayed. At first, the ranges are set so wide that everything will “qualify” to be shown.

But, for instance, let’s say you wanted to see if you had any really low-volume stocks in your watch lists that you wanted to strip out. You might set the Max Volume to be 100,000 and see what symbols are left. Or perhaps you never trade anything over $100 per share.

Therefore, you’d set the Max Price to 100. The applications are really up to you, since the filter is just as useful for finding desirable symbols as it is for finding undesirable ones.

After you click the Apply button, the watch lists will be displayed with the new, almost certainly smaller, collection of symbols. One helpful feature is that watch lists which are affected by your filters are shown in a lighter color, whereas lists that still have all of their symbols intact are shown in the regular blue color.

There is also a checkbox labeled Options available for trading. Checking this will result in symbols being displayed which are underlying instruments for put and call options. This is a quick way to focus on just those symbols which have options-based trading opportunities. Of course, you can use a combination of price, volume, and this checkbox in order to focus only on options ideas for heavily-traded underlying instruments.

Lastly, you can likewise filter out the symbols with the Filter by Sectors menu choice. This is also such a feature-rich part of SlopeCharts that there is a dedicated page for it, which you can access here.