I suspect some of you saw the article over on ZH about the “trader” who had the misfortune of having his entire account short KBIO which ripped about 700% higher this morning. The guy blew out his entire account (and a lot more) and put up this page to ask for people to help him make his six-figure margin call (the margin call itself is three times bigger than the original account). As of this writing, he’s raised about 1.8% of what he owes Etrade.

Having read the text of his GoFundMe page (which is typically used for more worthy causes, such as helping out families or individuals with medical emergencies or charitable organizations that need assistance), I wanted to review the entirety of his missive, since I think there are some important lessons in here. I’ve cleaned up some of the more egregious misspellings and syntactical errors, since it bothers me to sully my blog with such things. Here we go:

Hello to all you traders out there. I’m starting this page out of the recommendation of other traders in the community.

It’s immediately apparent that this chap prides himself being a “trader”. I’ve been doing this for nearly 30 years, and if someone asks me what I do, I’ll normally say “I’m a writer.” There’s really no reason to put on airs about buying and selling stuff.

I hesitated on doing this but I literally owe Etrade $106,445.56 as of this moment what would you do if you were in my situation? I’ll do what’s needed and sell what I have to get them paid but if someone feels my pain and is willing to help out—who am I to say no?

If you don’t want to donate I understand, at least read my story of what happened today and protect yourself from the same happening to you! This is a terrible lesson for me but if this helps just one person than I’m happy I wrote this. I’m a fairly new trader, been trading since about March of this year. I have learned a lot about the community and trading…well not enough about trading as you will soon hear.

I don’t want to donate. I’m glad you understand.

I have a fairly small account, but it’s over PDT. As of this morning it was $37,000. I keep it small because I wanted to manage risk, the most I can afford to lose is what I have in the account….$37,000. When I get some profits I take them out of the account because I wouldn’t want to lose more than $37k.

I was holding KBIO short overnight for what I thought was a nice $2.00 fade coming. At the close of the bell I saw the quote montage clear out and figured today there was no action after hours in the stock. So I went to my office for a long meeting. I got out of the meeting and saw a message from one of my buddys, he asked if I was ok since I was short KBIO….my heart dropped. “Shoot did I blow up my account, everything I worked for? I don’t want to lose all $37,000 that would be terrible.” —It was much worse.

I have no idea what “PDT” means. As far as “a nice $2.00 fade coming”, it sounds like he assumed the stock was going to drop 100% (I’m not sure what “fade” it is he’s speaking of; perhaps the esoteric language makes him feel more like a “trader”.)

The stock was at $16 and my account was negative over 100k. I figured it was a mistake, Etrade would never let that happen, they must have cut the position when my account got to $0….nope. I immediately called them and they confirmed I still owned all the shares. He says that it got out of hand too fast for them to cover me, he says that all he can do right now is cover. I was devastated. I asked him to cover at $16 and he waited trying to find me a good exit. I told him to do it asap and the fill was around $18.50 avg.

All right, this requires a little more dissection. “Etrade would never let that happen”. Umm, yes they would. A broker isn’t a wet nurse. They have millions of accounts. What is it that they “let” happen, exactly?

And you didn’t “own” the shares, Mr. Trader. You were short them. Big difference, especially in this case. I’m also not sure who you got on the phone who pretend he would “find (you) a good exit”, but, ummm, these guys just press Buy To Cover and it’s done. There isn’t much nuance here. You don’t “find a good exit” The market is what the market is.

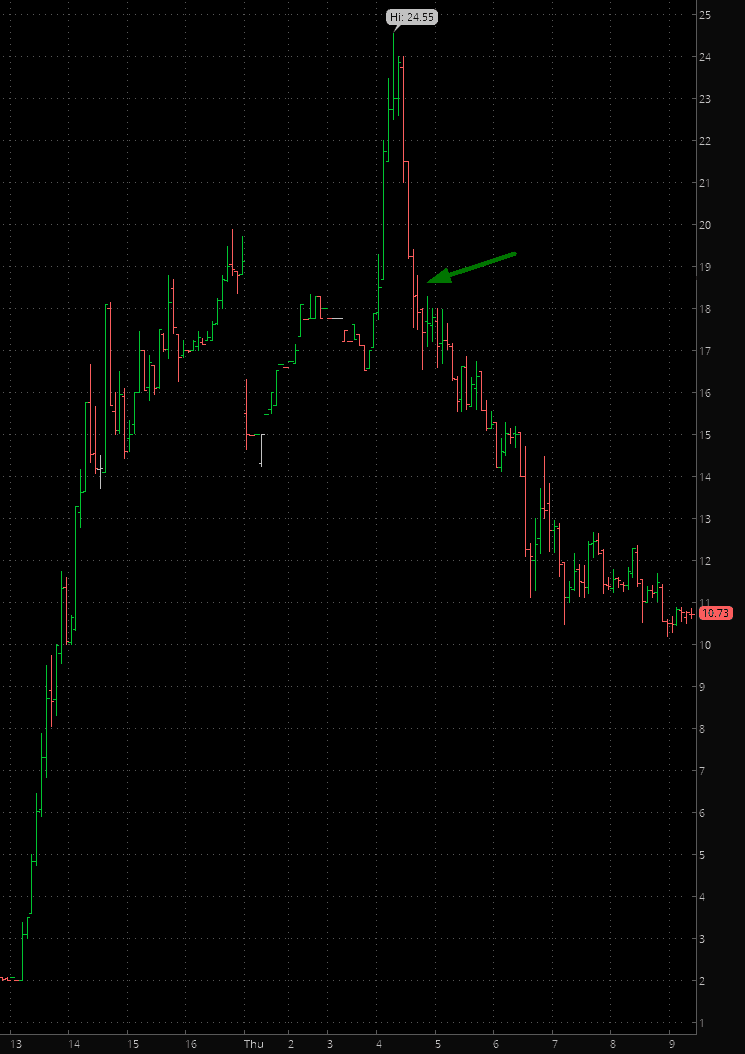

Oh, and as far as the “good exit” at $18.50, I’ve marked it with an arrow here. This doesn’t even reflect the fact that the stock slipped as low as $8.58 today, which means your good exit was nearly ten bucks higher, or more than 100% above. Covering a thinly-traded stock pre-market is just lunacy, although I can sympathize with the panic and wanting to make sure it didn’t go to $30 or something.

At the moment not only is my $37k gone, but I now owe ETrade the negative balance of over $106k. I always knew I could blow up an account and I was financially able to “afford” to lose the $37k. Never in my wildest dreams did I imagine that Etrade would NOT have some sort of stop or circuit breaker in place that would automatically cut a position if the account went to $0…..how could they ever let it get to -$144k loss on a account that small! Also, why did I have to call them to find out what was going on, why did they not alert me or call me when it went neg???

They didn’t alert you or call you because they’re not obliged to do so. And it wouldn’t have done any good anyway. The real idiocy is not only shorting a $2 stock (and a volatile one at that) but having that as your ONLY position. That’s nuts. For myself, no individual position accounts for more than 1.5% of my portfolio (typically 1%) and I try to short stuff which is – – well — priced high!

I’m never one to ask for a handout and honestly I’m kinda not sure if I should post this but here we go. I’m sure it will cause lots of controversy on whether or not I deserve even a $1 donation but it doesn’t hurt to ask. Anything you traders can do to help me get a little out of this hole would be a blessing for me. Anything donated will go 100% to simply paying Etrade some of this $106,445.56.

My plan moving forward is to liquidate mine and wife’s 401k’s and try work out a payment plan with Etrade. I’m also going to ask them to help out in some way…that’s a longshot. I will pay them and be back trading….only with set stops this time. What an expensive lesson that was.

I guess the insanity is consistent. You’re actually planning to tell your wife that you are going to liquidate her retirement savings to pay for this glorious fuck-up? I’m not sure what your obligations are, but scurrying around to pay ETrade as soon as possible – – – nah, I don’t think that’s a high priority.

I hope my story helps someone else from the same.

I hope so too! This entire debacle reminds me of the Casey Serin saga, about which I wrote extensively during the financial crisis. He was a guy in his 20s who bought millions of dollars of real estate based on liar loans and got wiped out. The main difference is that repaying those to whom he owed money never crossed his mind. At least the guy described above has the decency to feel obliged to make Etrade whole.