I’ve done many, many posts about the insane real estate market here in the Bay Area. I’m not going to bore you with another “can you believe how much they want for this?” because, by now, I think you kind of get the point.

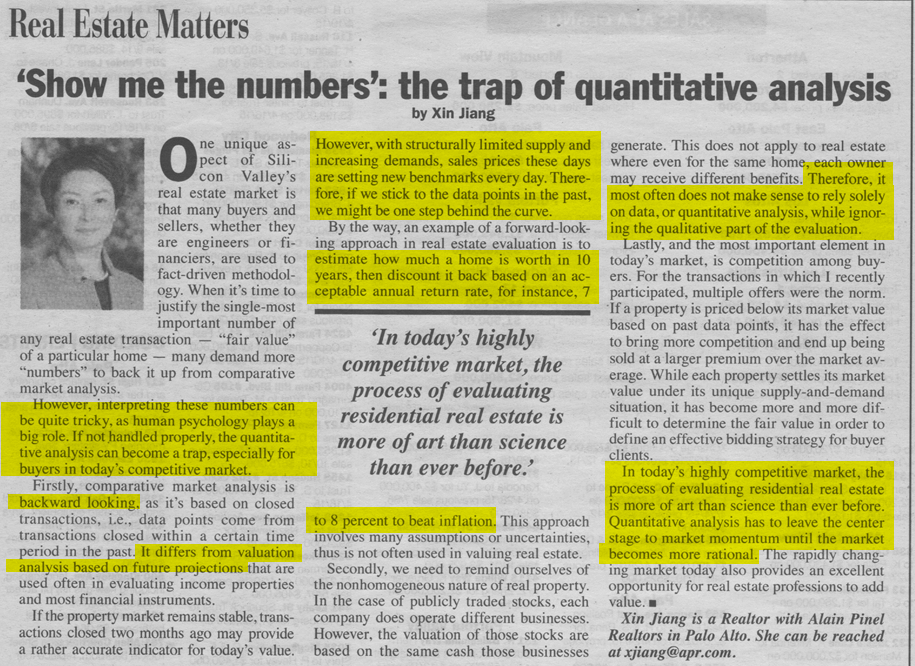

However, this week, in the venerable Palo Alto Weekly (which, as is typical for the newspapers around here, has a publishing frequency that has absolutely no correlation to its moniker) a local real estate agent, Xin Jiang (pronounced “Xin Jiang”) composed the following article, which I have helpfully highlighted for you:

(as always, you can click on the image above to see a bigger-ass version of it)

(as always, you can click on the image above to see a bigger-ass version of it)

Through a tortured logic, the article above essentially states that there’s really no point in computing fair value based on historical data. Instead, as with “mo-mo” stocks, it’s all about human emotion and the lack of supply on the market. She states setting prices is presently “more art than science”, which is more elegant than “pulling a figure out of an orifice that the market might just accept.”

Suffice it to say that I’m glad I bought in 1991, and I deeply, deeply regret selling the two other pieces of real estate I had in this area, one in Sunnyvale (up 250%), and the other also in Palo Alto (up 50%). Anyone buying at present price levels (and simultaneously acquiring a tax basis on which they’ll be paying over 1% the rest of their lives) is acting more on emotion than good sense.