This is a movie recommendation – nothing to do with trading. Here’s the trailer for a 1993 movie I have always been crazy about (and I re-watched this week for the umpteenth time). Trust me, it’s fantastic – Short Cuts, a Robert Altman film:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Is Gold Hated Enough?

By Biiwii

An article by Mark Hulbert jogged the title’s question into my mind:

An article by Mark Hulbert jogged the title’s question into my mind:

This Bear Market in Gold Still Has too Many Bulls

With respect to the reasons for owning gold, I never flinch when taking a long-term value perspective. In the monetary and financial world gold is insurance and insurance is something you buy, but hope to never need. The value of insurance is in one of its definitions: “a thing providing protection against a possible eventuality”.

It is good news that this ‘thing’ has not been needed as modern policy making has worked to mostly desired effects, as asset markets have been pumped by inflationary policies that have not (yet) had a commensurate level of risk discovery.

Vanity Goes Meta

Unless you reside in a cave, you know that every month, like clockwork, world-famous narcissist Oprah Winfrey puts out the latest edition of her “O” magazine featuring none other than herself on the cover. This woman is huge, both literally and figuratively, in the world of celebrities, and who I am to judge the taste or wisdom of cranking out this monthly nod to megalomania?

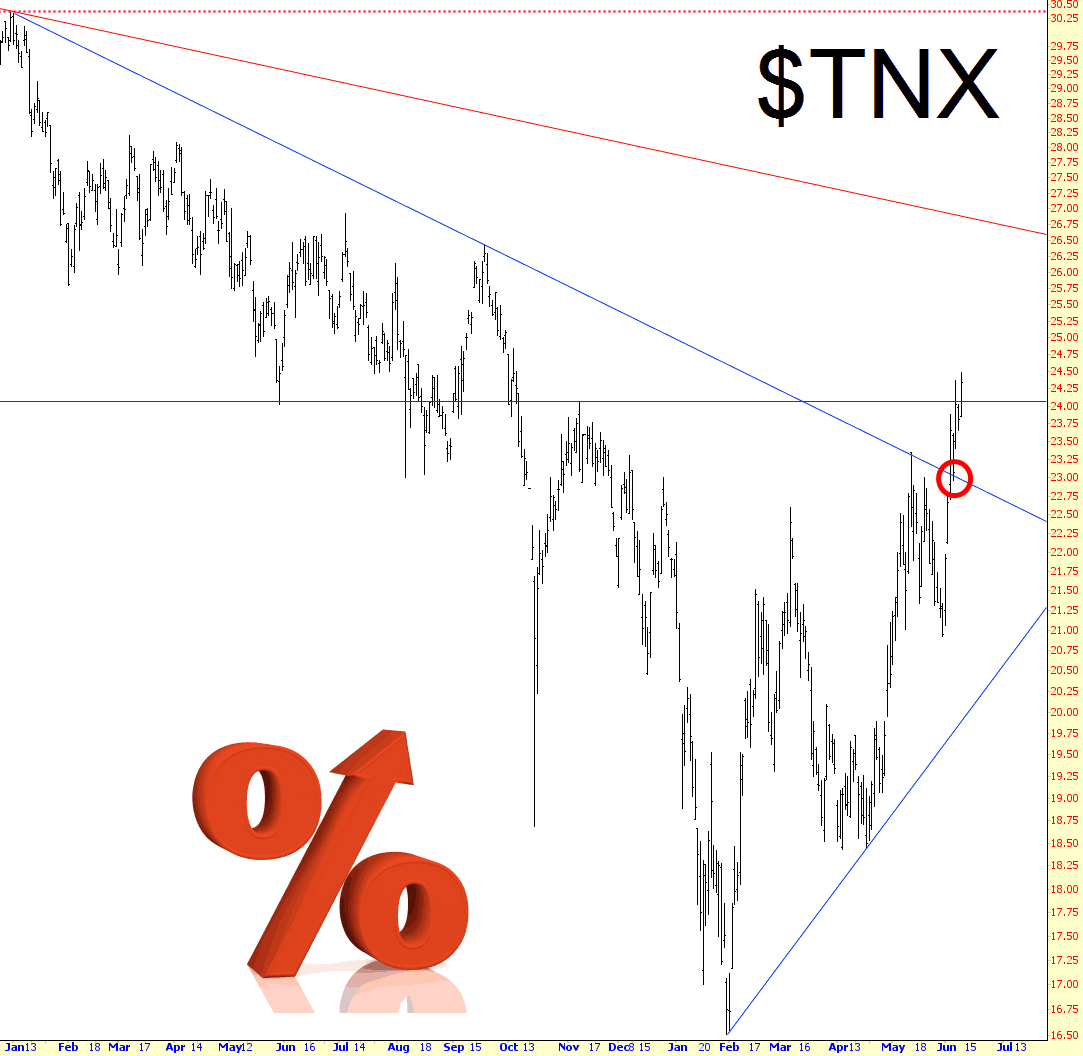

Interest Rate Rally

When I pointed out the trendline break interest rates made last week, there was a hail of chortles and catcalls about how useless it was, since it was so “obvious”. There is nothing wrong with an obvious trendline break. Just because you know that more than one person is watching a given technical breakout doesn’t invalidate it.

The naysayers got one day of glory, as interest rates did dip and simply test the breakout the next day, but since then, it’s been up, up, and away. I’d say that the nations of the world, which are countless trillions of dollars in debt, are pretty much screwed and tattooed.