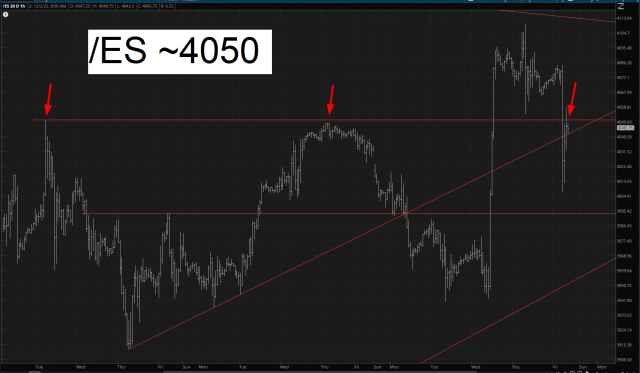

I guess it could be worse. Still, it’s disappointing that today’s low was literally within 200 seconds of the release of the jobs report. Equities have been climbing ever since. I wanted to show a few interesting price levels I’ve noted. First off, 4050 on the /ES has acted as resistance, with the exception of the post-Powell-speech portion. As I’m typing this, the /ES is trying to fight its way past this and eliminate the entirety of the jobs report drop.

The line here on the /NQ may seem oddly placed, but it has switched roles from resistance to support. It also represents the bullish base (such as it is) for extending the rally into the rest of the year.

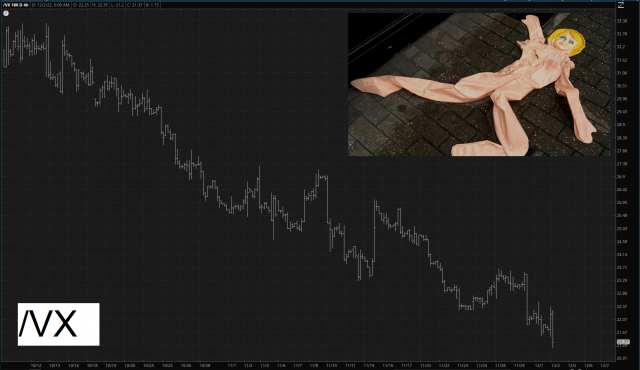

Through all of this, volatility continues to get smashed into oblivion. The cash VIX almost got to an 18-handle today.

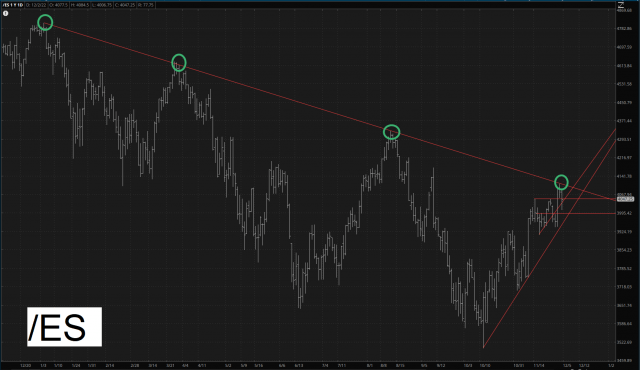

In spite of this relative disappointment, I can at least applaud the fact that the descending trendline on the /ES, intact for the entirety of 2022, remains unbroken. But by God, we got dangerously close this week.