Good morning, everyone, and welcome to a new week. This weekend clearly didn’t have the drama that last week did, although people were anticipating much worse. I suppose this is the reason that gold went absolutely ape on Friday, and near its peak, I bought GLD and GDX puts. These two positions are the only ones which expire this year (32 days from now), so for me it’s relatively time-aggressive, but – – so far, so good. There was a nice gap down (arrow) and we’ve already burned off some of Friday’s zeal.

Another former safe haven which is still utterly in the cold is bonds, which are down almost a full percentage point as I’m typing this. Soaring interest rates are definitely back in fashion.

Pre-market, equities are higher by about one-third percent to a full percentage point on the futures, as the chatter resolves around a diplomatic solution to the Hamas situation. Let me say this about that: quick fixes to new wars are a given. The civil war was supposed to last a month, and it lasted five years. The “war to end all wars” in the early 20th century wasn’t. And, just days after the Ukraine war started, there was talk of a settlement. What I’m saying is……….they ALWAYS pull this stunt.

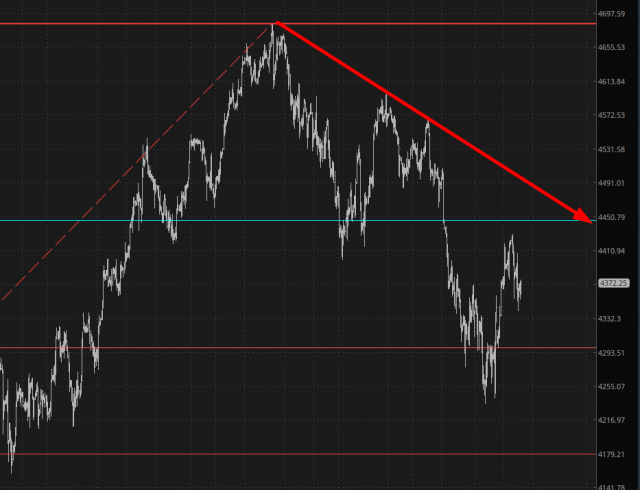

In spite of the short-term strength we’re seeing, I still have faith in the clarity and size of the topping patterns. I remain fully invested on the short side, and as I said, my only short-term play is related to precious metals. Here, below, is the Russell 2000 futures, which I think speaks volumes: