My three Fed Stimulus Program "Canaries" are

beginning to lose steam after today's (Wednesday's) gap up and fade on

negatively diverging RSI, as shown on the Daily ratio charts

below.

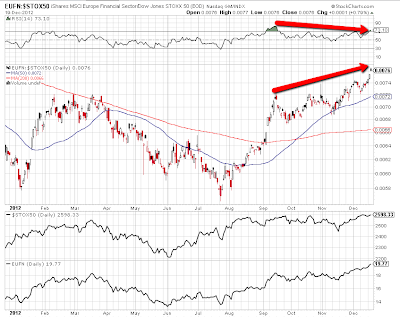

Such is also the case on the European and Chinese

Financials ETFs (compared with the SPX), as shown on the following

Daily ratio charts.

Perhaps the noxious gases from

the "Fiscal Cliff" discussions are beginning to have an effect,

as traders take profits, before the U.S., potentially, goes over the cliff at

the end of this month. Both political parties seem as far apart as ever, with no

resolution in sight.

Meanwhile, the

SPX:VIX ratio closed below major support (broken blue

horizontal line) today, as volatility increased. Momentum has hooked down and is

below zero again, so I'd look for increasing volatility, with the heightened

probability of further downside on the SPX.

SPX:VIX ratio closed below major support (broken blue

horizontal line) today, as volatility increased. Momentum has hooked down and is

below zero again, so I'd look for increasing volatility, with the heightened

probability of further downside on the SPX.