As most of you know, I don’t tend to be the buy-and-hold sort. Would that I were, surely I’d have many more millions than I do now. But – ah well – cursed by a depressive personality, I suppose. But as I’ve said before, there have been two rather involuntary buy-and-holds, and both have done amazingly well. One is a business investment, which will probably pan out wonderfully, and the other is my house. It is this second one that is getting an unusually large amount of attention, given the insane environment in which I live.

Just yesterday we got this in the mail (and we’ve received many like it recently):

Cute as Lori’s picture is, I’m not really compelled to find out how many millions in cash we could get for our home. It would have to be way over five. And, to quote Daniel Plainview – “what would I do with myself?” My dogs are buried here, after all. I’m not leaving.

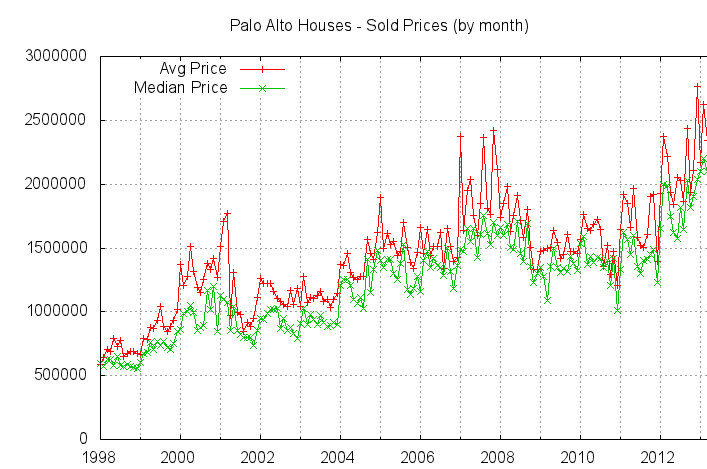

A chart of Palo Alto home prices shows that the sub-prime meltdown didn’t really cause a big dip here. The main reason, of course, is that Palo Alto isn’t exactly ground zero for subprime. Stockton is (which, unfortunately, is precisely the dump of a municipality from which I’m typing this blog post for you).

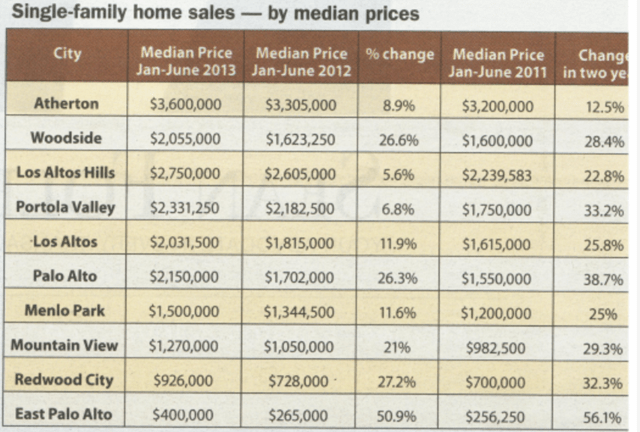

Of course, there are ritzier towns than Palo Alto. You can glance at this table, which I have thoughtfully scanned for you from a weekly paper, and see some of the leaps that have taken place recently. In case you’re wondering what the deal is with East Palo Alto: it was the murder capital of the U.S. in 1991. It’s sort of the ghetto of the area, which makes it affordable. But check out the 50%+ increase in home prices. You’ve got to sell a lot of crack to cover those higher mortgage payments.

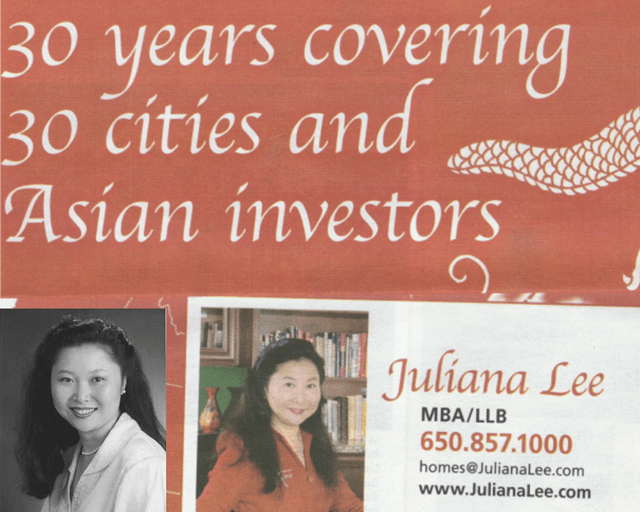

And of course, cash-only buyers from China are all the rage right now. I’m sure these buyers will be as delighted with their profits as the Japanese were in 1989 when they were running around buying up Pebble Beach and the Empire State Building. If you happen to be a Palo Alto real estate agent who is also Chinese, so much the better; below is a portion of a full-page ad that long-time real estate agent Juliana Lee has been running. (I will note that Ms. Lee continues to use an old photo, when she was still kind of cute, in a lot of ads and signage; I can only imagine the surprise of new clients when they meet the now far-more-doughy agent for the first time; I’ve juxtaposed the pictures herein – again – thoughtfully).

When I bought my house in 1991 for $542,500, relatives near and far told me what a huge mistake I was making. Over and over I would hear things like “In Bumblefuck, Texas, I could buy a house five times than big on 300 acres for that much money!” Well, I doubt the property in Bumblefuck has appreciated 10-fold since that time. But there’s a difference between buying, say, Google at $100 (in retrospect, a great decision for those who did) and buying right now at $1000. I think Google – – and my house – – are, as they say, “fully valued.”

If you still want to get in on this hot market, though, be my guest. Here’s the palace you can pick up for $3.65 million (although that’s just the asking price, which doesn’t tend to be the selling price, as there are always multiple bids).

And if you have the happy fortune of being a founder of, say, Twitter, or some such thing, you can dream bigger. Say, for instance…….

Anyway, I’m staying put. And speaking of puts……..I still wish I could buy one on my property.