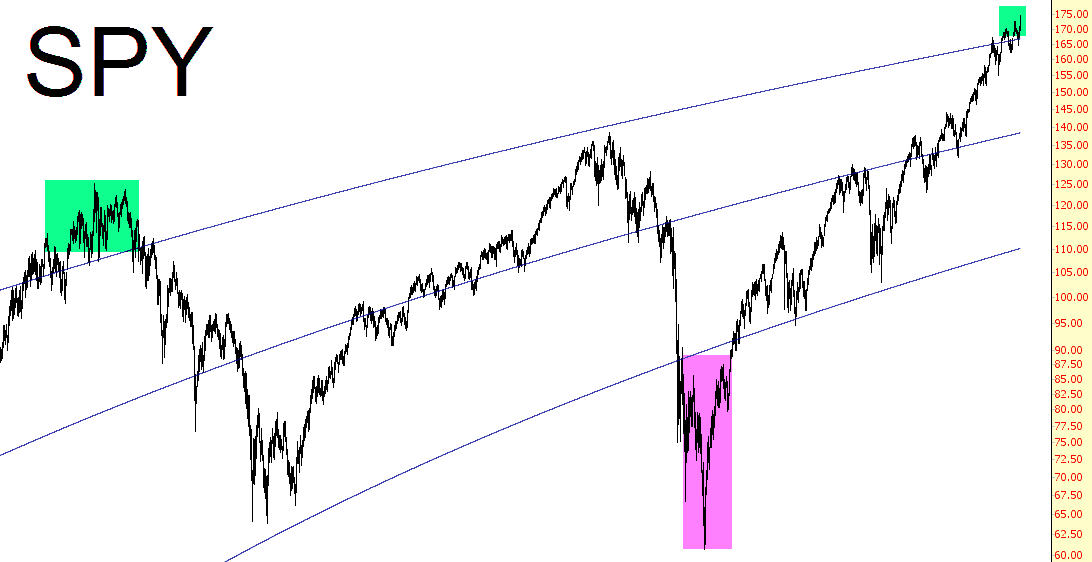

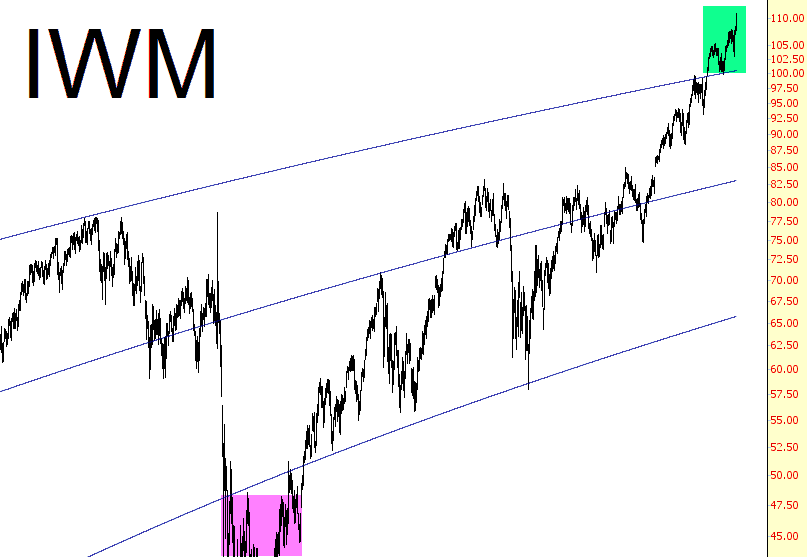

A thoughtful Sloper (are there any other kind?) wrote me this morning to mention what a breathtaking setup was taking place on index ETFs vis a vis their 50% linear regression channels. (Party Pro Tip: use the aforementioned sentence, without the parenthetical remark, at a forthcoming social event; members of the opposite sex will gather and swoon). I hereby present to you my charts on this matter:

As you can see, we have broken the surly bonds of Earth, but the problem is, as history has shown, that such overshoots are possible and sometimes long-standing. There is virtually no doubt in my mind that stocks are very, very, very expensive in this environment (in spite of the comic “stocks are cheap” drumbeat). However, stocks were expensive in May of 1999 (look at the top chart, where the green is tinted) and they just kept getting more expensive for the next 10 months.

I think it’s virtually assured that stocks will be substantially lower in a year. The unfortunate thing – for me at least – is that stocks might keep defying gravity for months on end as the deluded public keeps on buying at increasingly outrageous values. Anyway, I’ll let the charts above speak for themselves.