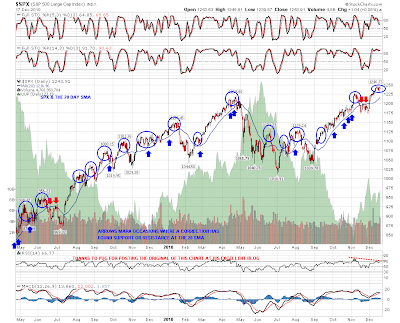

I was asked an interesting question last night, and it was in response to my saying that we had been chopping around in the same area for a week, which is generally a good signal that a top is being made. I was asked how many such formations had turned out to be consolidations in the last two years on SPX and I estimated fewer than one in three. Looking at it this morning the correct answer is actually much fewer than that, if the formation is well above the daily 20 SMA when it forms:

We've also hit support on Vix on Friday on the daily chart, where the resistance trendline for the year to April 2010 has since been a strong support trendline:

That's not to say though that we can't rise a bit further and I see on the ES 15min chart this morning that a megaphone has formed overnight that indicates to the 1250 area on an upward breakout. It may just be an overthrow but it appears to be breaking up, and I see that ES has now reached a level slightly higher than the previous highs a week ago:

EURUSD was weak overnight and is stalling again at a level that looks very significant on the USD chart. If this resistance level on USD breaks then the way looks clear to rise to the next significant resistance level at 83.65:

TLT has reversed earlier than I expected, and looking at the chart this morning what I thought was a broadening descending wedge is resolving into a falling wedge. The upside target for this move up is therefore in the 96.5 area:

Which way am I leaning this week? Well if it wasn't Christmas week I'd be leaning strongly short. However it is Christmas week and it will be a low volume, heavy POMO week so I'm a bit doubtful about seeing much in the way of downside on equities until the week after Christmas which is a very different story. Last year there was a decent correction to the 20 SMA on SPX in the week after Christmas as you can see on the top chart. Meantime I am very aware that my rising wedge target on ES is in the 1265 area now and it's still just possible that could be reached. We'll see.