A quick time-out from my mini-holiday to report this…

Data released today showed a further drop in the Swiss economy, as shown on the graph below (courtesy of www.forexfactory.com). It's a combined reading of 12 economic indicators related to banking confidence, production, new orders, consumer confidence, and housing. It's designed to predict the direction of the economy over the following 6 months. The impact tends to be significant, but varies from month to month. It's just another set of data that's been released lately which confirms weakening in the European economy.

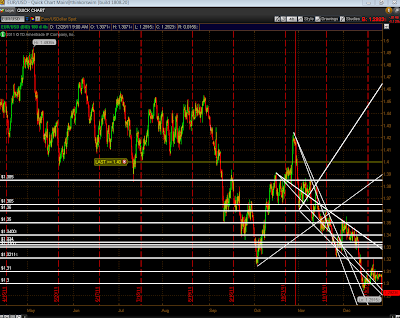

At the moment the EUR/USD has broken below recent support of 1.30 and is hovering just above a downtrend line, as shown on the 4-hour chart below…it has made a new low today over the course of the past 180 days.

Additionally, the European Financial ETF, EUFN, has also dropped in today's trading and is sitting just above recent support of 14.70, as shown on the 4-hour chart below…it is showing relative strength to the EUR/USD…further weakening of this ETF should have a negative impact on the Euro, particularly if it breaks its 180 day low of 13.71.

Back to my holiday…

http://strawberryblondesmarketsummary.blogspot.com/