I'm aware of three types of gaps — usually occurring in a sequence in a

trend:

- Gap 1 = Breakaway Gap

- Gap 2 = Continuation Gap

- Gap 3 = Exhaustion Gap

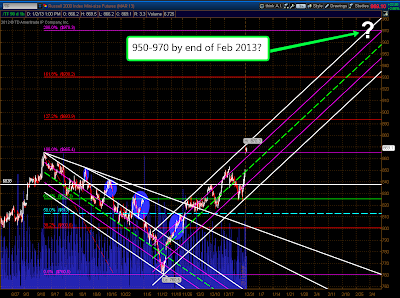

We'll see, in time, if today's

(Wednesday's) gap on the TF is a Continuation Gap. If so, then it has a long way

to, ultimately, run before it hits the third type…essentially another 100

points, or so, to around 950…although, not likely straight up! I would note

that the Breakaway Gap (which began the current uptrend) remains

unfilled.

Since the formation on the 60 min (market hours only) chart

below resembles that of an inverted Head & Shoulders, this target could be

actualized…the timing, however, is unknown.

Price could,

potentially, simply continue rising along the upper edge of the channel (shown

on the 60 min market hours only chart below) to defy any overbought conditions.

Or, it could zig-zag upwards within the channel to reach 950-970 by the end of

February 2013. That would tie in with the date by which Congress will have to

reach an agreement on the rest of the "Fiscal Cliff" issues, as well as raise

the "Debt Ceiling Limit."

potentially, simply continue rising along the upper edge of the channel (shown

on the 60 min market hours only chart below) to defy any overbought conditions.

Or, it could zig-zag upwards within the channel to reach 950-970 by the end of

February 2013. That would tie in with the date by which Congress will have to

reach an agreement on the rest of the "Fiscal Cliff" issues, as well as raise

the "Debt Ceiling Limit."