Greetings from the CalTrain station in bucolic Palo Alto, California. I thought I’d have a change of venue to type up my end-of-day post, and although a video would have been a lot easier, I’m going to not to be lazy this time.

Greetings from the CalTrain station in bucolic Palo Alto, California. I thought I’d have a change of venue to type up my end-of-day post, and although a video would have been a lot easier, I’m going to not to be lazy this time.

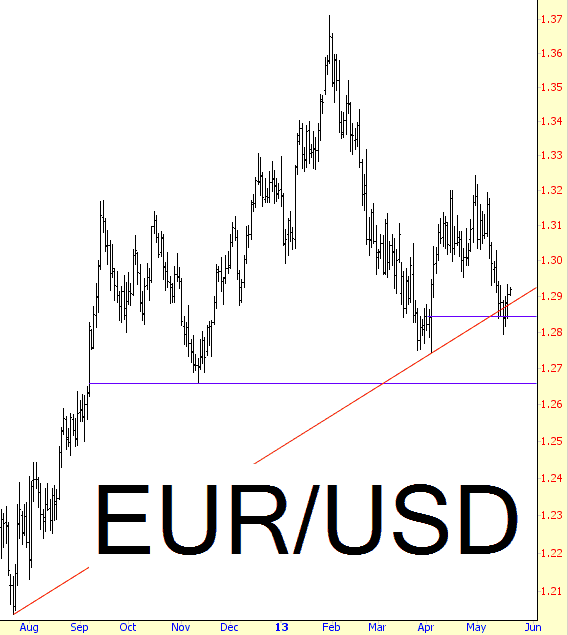

There’s not a whole hell of a lot to say about a market that goes up every single day. There are only so many instances of, “wow, this market is sure going up a lot lately” that one can utter. One item I’m rather impatiently watching is the EUR/USD, which is configured for a nice tumble, but so far refuses to do so.

One thing is clear, however. Whatever speech Bernanke has prepared for 10:00 EST tomorrow is going to be a market-mover, and an instantaneous one. There’s not much point in watching any quotes between now and then, because what comes out of those beard-shrouded lips is going to make or break things.

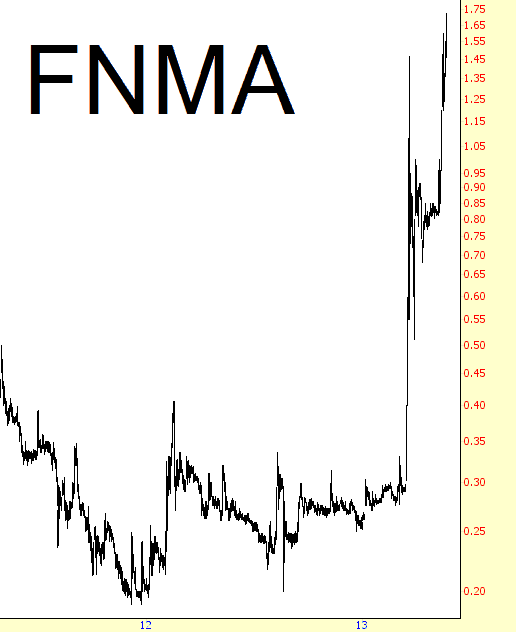

If you want evidence as to how insane this market has become, think back to the old maxim about how, in the final stages of a bull run, even horrible shit floats to the top. Fannie Mae, the poster child of the financial crisis, offers a superb example of this. Just amazing:

Of course, there are still good buying opportunities. I am about to choke on my tongue to offer this one, but honestly, Groupon looks like a really clean breakout pattern on the long side.

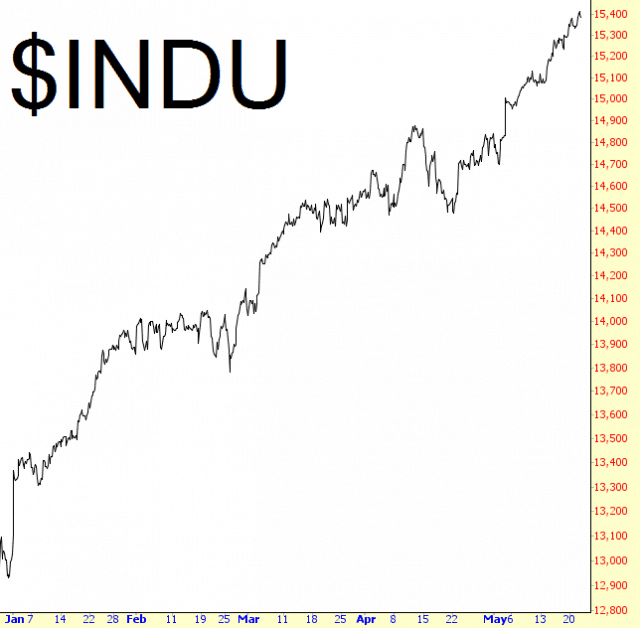

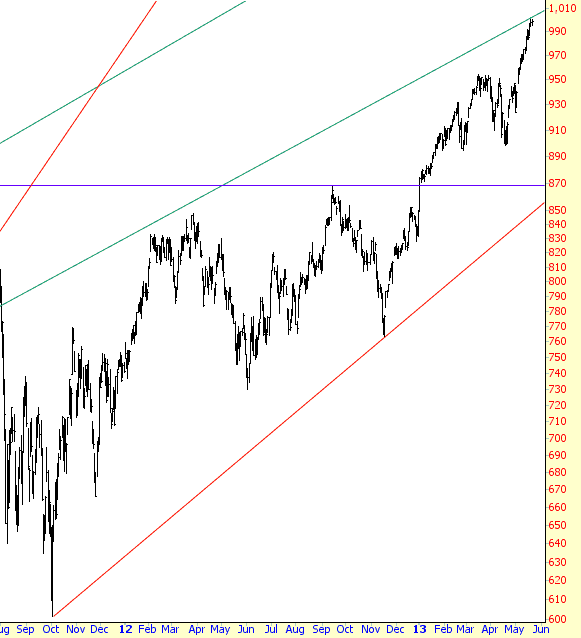

This upward-run has reminded me of the old tale of the frog being boiled to death slowly in a pot of water; the heat goes up just a tiny little bit every day, but one by one, the bears have been boiled to death without feeling the pain instantly or acutely. The Dow 30 captures this nicely, with a three-freaking-thousand point increase in a mere six months. Disgusting.

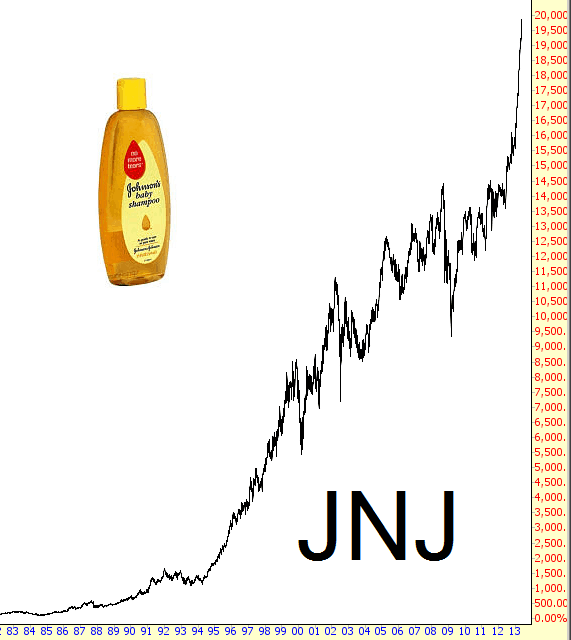

And, just to drive the nausea home, take a good at red-hot Internet startup Johnson & Johnson, which is making huge breakthroughs in 3-D printing, social blogging technologies, solar panels, electric-powered sports cars, and Martian colony infrastructure. Oh, wait, sorry, that’s not right. They make fucking baby shampoo. And they’re up twenty THOUSAND percent.

Do I sound bitter? Yeah, I probably do. Anyway………

Just about the only index that hasn’t had its trendlines gang-raped is the Russell 2000, on which I am short by way of the IWM. It has crossed into quadruple-digit territory, and, ironically, Bernanke is pretty much our only hope of reversing this beast (which, if he does so, may well be accentuated by the Fed Minutes, also coming out Wednesday).

I will bid you a fond farewell at this point as I turn my energy to other matters. Good night, and thank you, as always, for being part of Slope!