Take a look at the chart of the QQQ below. The tone and temperment of the market changed completely on May 22nd. It divides the before-time from the after-time, and the change in character is so extreme that it’s hard to believe it’s the same market. (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Russell Crows

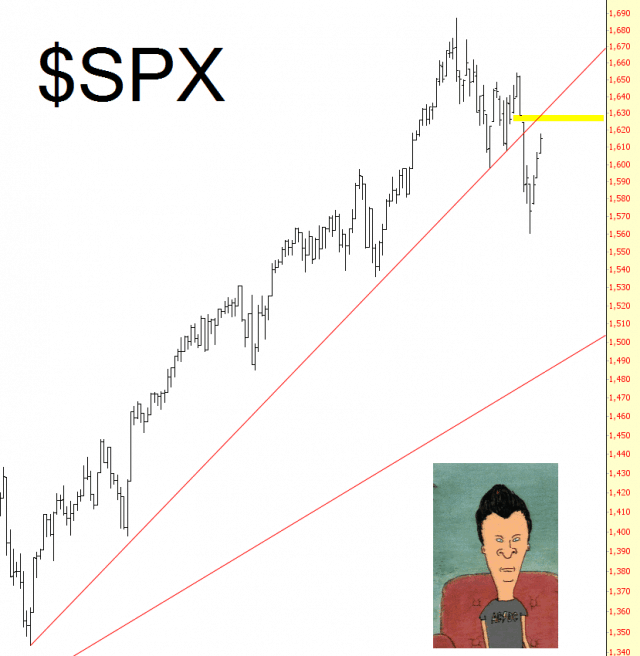

The market ceased its delicious fall early this week, and it’s been a miserable rocket-shoot ever since (excepting, of course, for kookapolis). I am trying to stay my hand to avoid shorting aggressively too soon, but gaps are being approached left and right. The Russell is particularly strong today, and I am watching this gap closely to get very short for the quarter ahead. I really don’t think three days of trading weakness constituted the Great Bear Market of 2013. (more…)

Day After Day Their Love Turns Grey

Yes, there are going to be bounces. Yes, sentiment is in the doghouse. Yes, we are really, really oversold. But the notion that gold is somehow a steal right now is, I think, misplaced, and people keep trying to catch this falling knife, sometimes with both hands. I think we could see gold threatening $1000 before the year is over (although $1050 is my best guess for a bottom). My point is that this is a very dangerous creature. (more…)