A Couple Of Interesting Months For Tesla Shareholders

It’s been a couple of months since I posted a hedge on Tesla (TSLA) (“Five-Star Safety For Tesla Longs“), about a month and a half since Tim presciently called a top in the stock (“The Telsa Top“), and about a month since we last looked at that Tesla hedge (“Cushioning The Blow For Tesla Longs“). In this post, I’ll recap that hedge and update how that hedge has reacted since.

The October 2nd TSLA Hedge

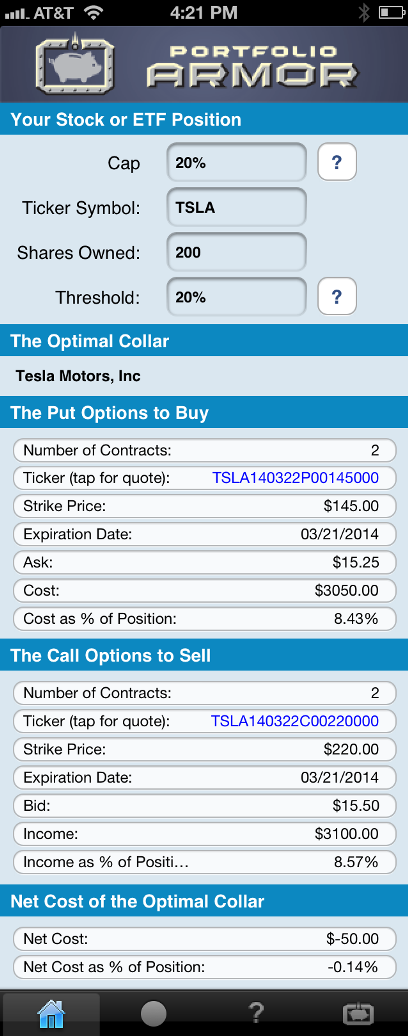

This was the optimal collar*, as of October 2nd’s close, that was designed to limit an investor’s losses to 20% over the next several months, for an investor willing to cap his upside at 20% over the same time frame:

As you can see at the bottom of the screen capture above, the net cost of that optimal collar was negative, meaning the investor would have gotten paid $50 to hedge.

How That Hedge Has Reacted To TSLA’s Drop

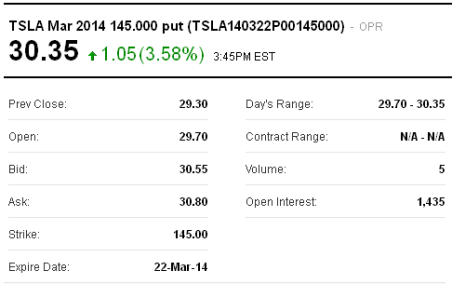

Here is an updated quote on the put leg as of Monday’s close:

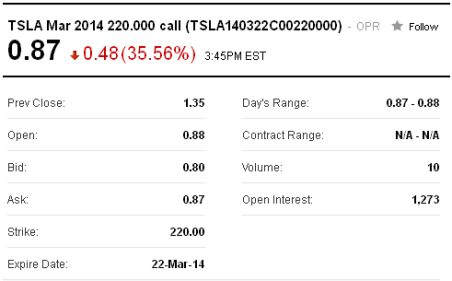

And here is an updated quote on the call leg:

How That Hedge Protected Against Tesla’s Drop So Far

TSLA closed at $180.95 on Wednesday, October 2nd. A shareholder who owned 200 shares of it and opened the collar above on October 2nd had $36,190 in TSLA shares plus an outlay of -$50 on the hedge, so $36,140 taking into account the hedge.

TSLA closed at $124.17, on Monday, December 2nd, down 31% from its price on October 2nd. The investor’s shares were worth $24,834 as of Monday’s close, his put options were worth $6,070, and if he wanted to close out the short call leg of his collar, it would cost him $174. So: ($24,834 + $6,070) – $174 = $30,730. $30,730 represents an 15% drop from $36,190.

More Protection Than Promised

So, although TSLA had dropped by 31% at the time of the calculations above, and the investor’s hedge was designed to limit him to a loss of no more than 20%, he was actually down only 15% on his combined hedge + underlying position by this point.

Options Give You Options

Being hedged gives an investor breathing room to decide what his best course of action is. A TSLA long hedged with this collar could exit his position with an 15% loss now, he could wait to see what happens, or if he remains bullish on TSLA, he could buy-to-close the call leg of this collar, to eliminate his upside cap. If he’s even more bullish, he could sell his appreciated puts, and use those proceeds to buy more TSLA. He has those options because he’s hedged.

*Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. Portfolio Armor‘s algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University. The screen captures above come from the Portfolio Armor iOS app.