Perhaps you’ve noticed how “lurchy” the market has become lately. Day after day, the ES rips this way and that, far more dramatically than in weeks past. It’s pretty obvious there’s a lot of angst about the jobs report tomorrow morning (and the interminable discussion of taper talks), so it’s not clear if the bulls or bears or winning.

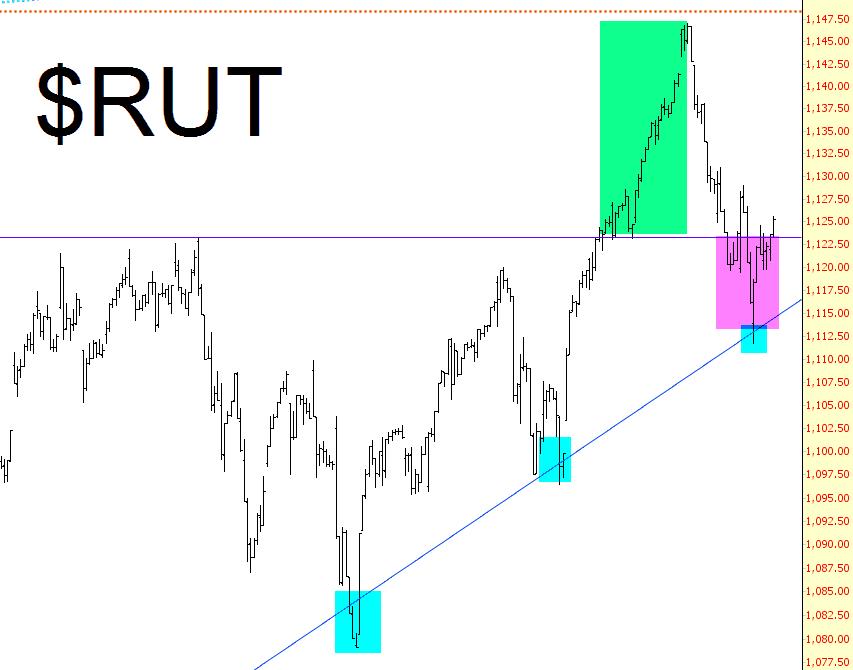

Looking at the Russell 2000 index, there are a couple of lines of interest. The horizontal line, which had constituted the bullish breakout, has been violated a number of times. Before, when the tinted green area was transpiring, power was clearly in the hands of buyers. The purple tint, however, indicates this bullish breakout has failed, and it will be that much harder for those prior highs to be beaten.

More interesting, the intermediate term support line, which dates back to the 11/16/2012 bottom, has been challenged several times (tinted in cyan) but has held each time. Tomorrow is a golden opportunity for the market to finally cut through this line with gusto. The market’s reaction to the jobs report will define the market action for perhaps the balance of 2013.