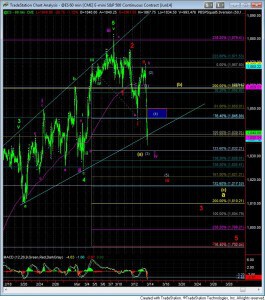

On Wednesday night I noted: “The bounce this morning is most likely a corrective bounce in an a-wave, which still needs a c-wave higher to complete the red (b) wave. So, unless I see something different into tomorrow, I am expecting the market to resolve this pattern lower over the next week. Hopefully, it can also break the cited support to make it more clear that the larger degree correction is upon us.”

On Thursday morning, the market hit the .618 retrace of the prior decline to the penny at 1867.50ES, and began this drop today. However, with the magnitude and manner in which we dropped, it has to open up a much larger potential count to the downside, as labeled in red.

But, first, the main count we were watching is now labeled in yellow, and provides that we are just about completing an a-wave off the highs. From here, if this indeed an a-wave, I would expect we can exceed the 1850ES level for a b-wave rally into early next week.

However, if the market maintains below the 1846ES level in a corrective bounce, and begins to head down and breaks 1832ES, then I will be adopting the red count, and looking for at least 1810ES with the potential to see 1790ES before this pattern off the recent high is completed. And, yes, that would be a 5 wave impulsive structure off the highs and signal a major trend change, if this should occur.

For now, I am going to assume that the 1832/33ES region will hold as support, and a rally will take us over 1850ES for a b-wave top early next week. But, if we break 1832ES, then all bets are off, and I am looking another 20 -40 points lows in 4th and 5th waves as we complete a potential 5 wave structure off the highs.

And, as you can still see, that purple count is still sitting there in the background, but it not a high probability potential at this time. But, it would likely be the pattern which would hurt most market participants the most out of all the ones on the chart, so it is being maintained in the back of my mind as the bullish alternative at this time.

First published on ElliottWaveTrader.net.