The last weekend the geopolitical instability generated by the Crimean/Ukrainian crisis affected the markets at the Open. From a human point of view, we hope that their situation evolves through peaceful steps with no more blood spilled.

However, if we are invested in the markets, we have to evaluate the implications of what happens there because it may hurt our investments.

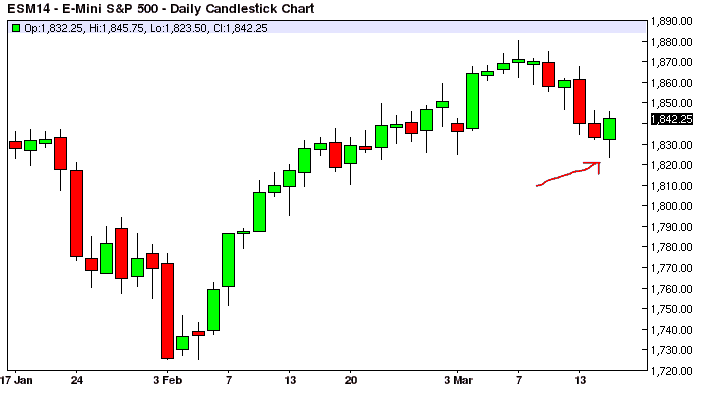

Here below you can see what happened overnight on the ESM14, the price reached the 1823 price area and then rebounded up above 1845.

The big dilemma for the investor, overnight, was: is the market going to go lower (i.e. keep my shorts open), or is the market going to bounce higher (i.e. it’s time to BUY)?

If you simply look at the chart above, it’s a question with no answer, there is absolutely no way to know what will happen.

Here is where RL can help. Our quantitative online tools (see below), were actually able to say that the price levels around 1833-1832 (DAILY and WEEKLY) had very good odds to go LONG and so it was time to take a LONG trade, especially DAILY, a reversal was imminent.

There are no other indicators on the market offering this type of information, they are unique because they combine specific price levels with their probability of generating a trend reversal.

One final consideration we would like to make is that the market is starting to be oversold, DAILY for sure, but also WEEKLY, so although we cannot exclude lower levels after the current rebound, it is possible, at least 50-50 possible, that this week the market is going to go higher. Nothing is sure, but once the odds start to cross the 50% point you have to consider that there is a high chance for it to happen.

If you want to sign up to the online quantitative tools shown in this post, please follow this link and subscribe to the special “SOH Offers”.

Copyright © 2014 Retracement Levels. All Rights Reserved