As we approach the end of the first quarter, it’s clear what a slow grind it’s been: January down, February up, March sideways. The S&P is up a roaring 0.50% over the span of three months, and that figure belies all the smoke and tumult behind the scenes.

Tops are very different than bottoms. Bottoms are made in violent, short-term bursts. The final plunge in early March 2009 washed out all the fear in a stroke, and a violent rise began.

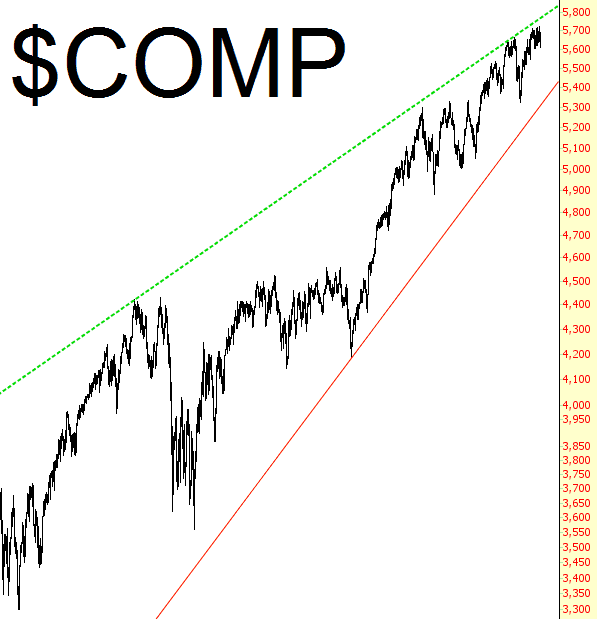

The nature of tops, however, is altogether different. They are plodding, boring, grinding, agonizing affairs. It’s hard to see it based on where we are, since we are simply levitating near the top edge of a huge wedge:

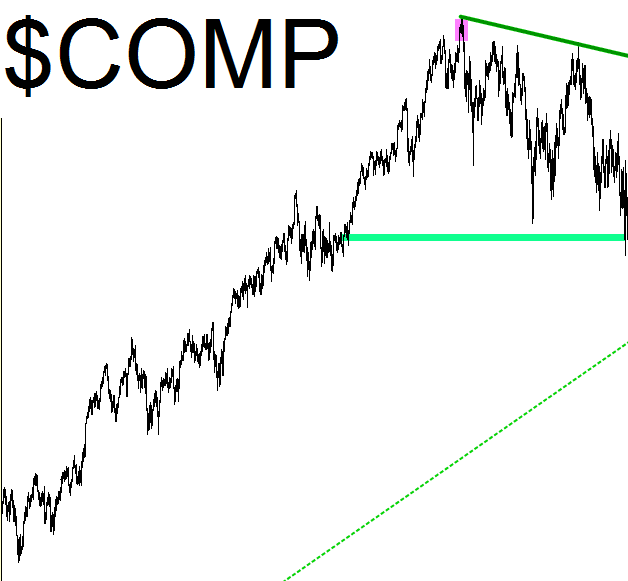

But if we look at the past, we can see how long it can take things to truly break down. The horizontal green bar I’ve drawn shows that the market took about two years going absolutely nowhere. This is immediately preceding the vicious collapse lower (not shown here). My view is that our current location is just about where that magenta tint is – – at the top of a very long, very slow grind downward.

I would also point out that indexes top out at very different speeds. I found the dual charts below fascinating – at the top is the Dow Jones Utility index, and at the bottom is the Russell 2000. In each case, they sported sensationally-clear head and shoulders patterns, but the curious thing is the very different timeframes it took to finish them. I must emphasize that the timespans you are seeing are identical below: one chart is not “stretched” vis a vis the other. But the Russell spent a lot more time shaping its top before plunging, even though both tops were remarkable in clarity.

The central planners and bankers around the world have learned their lessons from 2008. They aren’t about to let the markets enter a free-fall. Thus, the downward market forthcoming is going to be even more drawn-out and mollasses-like than what we saw half a decade ago. As the old saying goes, nobody rings a bell at a top – – and even if they could, Yellen would just wrap the bell in a towel to make sure nobody could hear it.