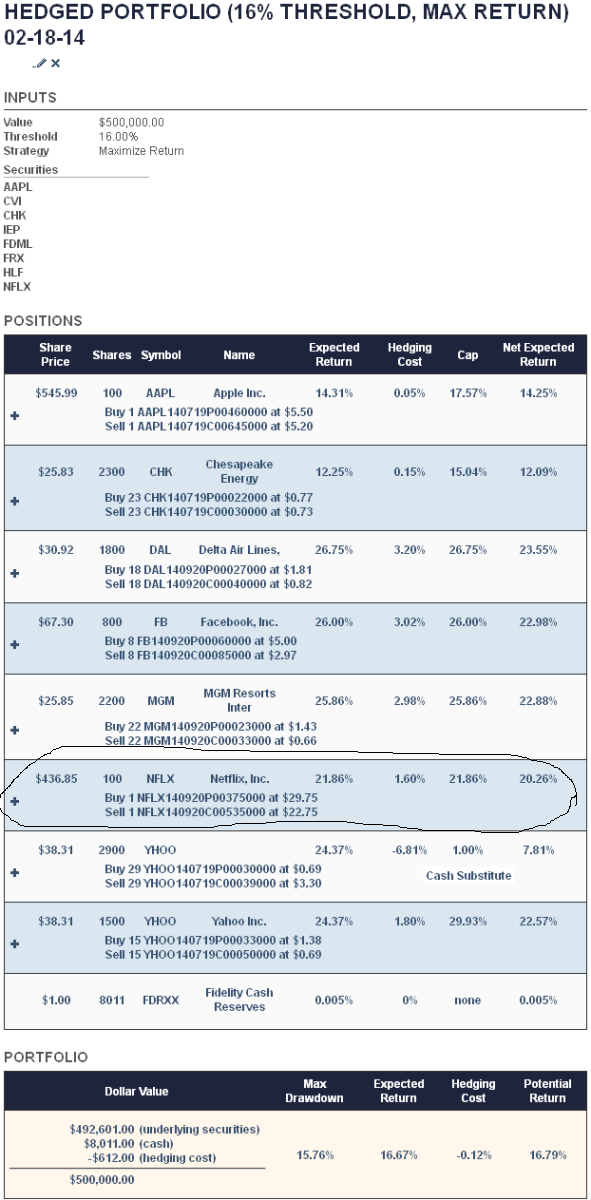

Shares of Netflix (NFLX) dropped nearly 7% on Monday, as Carl Icahn told CNBC that he may have sold half of his Netflix stake. In a post last month (“Investing alongside Carl Icahn while limiting your downside risk”), we presented a hedged portfolio constructed out of the holdings of Carl Icahn’s Icahn Enterprises (IEP) by the automated portfolio construction tool at Portfolio Armor. That portfolio included a hedged Netflix position, circled below.

In the portfolio above, each non-cash position was hedged with an optimal collar against a greater-than-16% drop. In this post, we’ll look at how that Netflix hedge would have softened the blow for NFLX shareholders since then.

How That February 18th Hedge Has Reacted To NFLX’s Drop

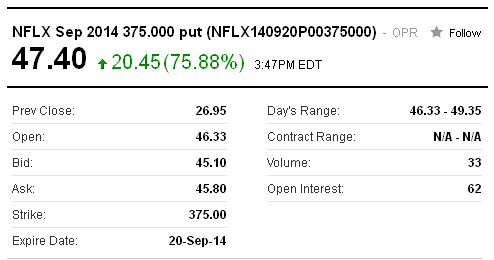

Here is an updated quote on the put leg as of Monday:

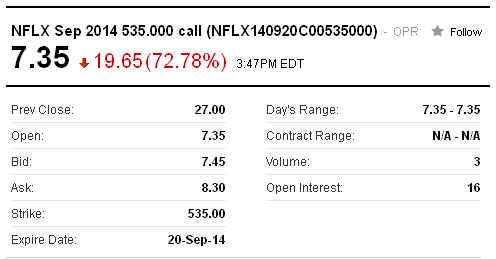

And here is an updated quote on the call leg:

How That Hedge Protected Against Today’s Drop

NFLX closed at $436.85 on February 18th. A shareholder who owned 100 shares of it and opened the collar above on February 18th had $43,685 in NFLX stock plus $2,975 in puts, and if he wanted to buy-to-close his short call position, he would have needed to pay $2,275 to do that. So, his net position value for NFLX on February 18th was ($43,685 + $2,975) – $2,275 = $44,385.

NFLX closed at $378.90 on Monday, March 24th, down 13.3% from its closing price on February 18th. The investor’s shares were worth $37,890 as of 3/24, his put options were worth $4,740 and if he wanted to close out the short call leg of his collar, it would have cost him $735. So: ($37,890 + $4,740) – $735 = $41,895. $41,895 represents a 5.6% drop from $44,385.

More Protection Than Promised

So, although NFLX had dropped by 13.3% at the time of the calculations above, and the investor’s hedge was designed to limit him to a loss of no more than 16%, he was actually down only 5.6% on his combined hedge + underlying stock position by this point.

Options Give You Options

Being hedged gives an investor breathing room to decide what his best course of action is. An NFLX investor hedged with this collar could exit his position with an 5.6% loss now (instead of a 13.3% loss), he could wait to see what happens, or if he remains a long term bull, he could buy-to-close the call leg of this collar, to eliminate his upside cap. If he’s even more bullish, he could sell his appreciated puts, and use those proceeds to buy more NFLX. He has those options because he’s hedged.