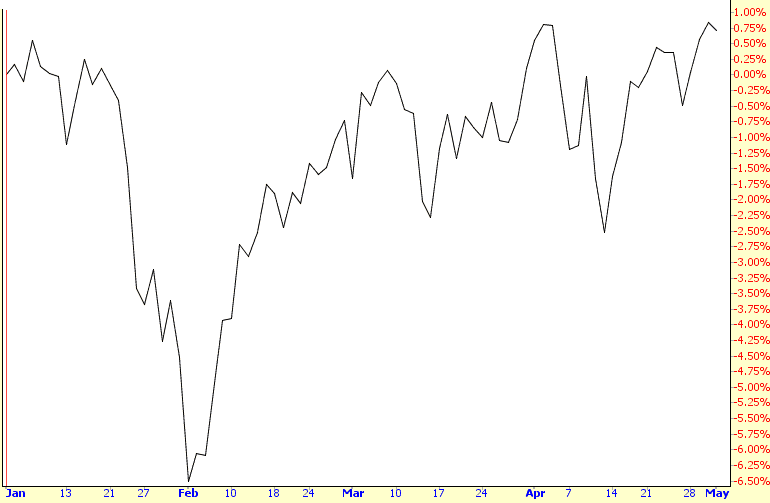

Here we are, entering the fifth month of the year, and 2014 has been pretty much a bore. Sure, there have been some points of excitement, but take one good look at the Dow 30 on a percentage basis, and you’ll see we’ve gone pretty much nowhere. There were headlines Wednesday about the Dow making lifetime highs – – which is true, of course – – but, again, looking at the chart below, it surely doesn’t mean much.

The initial free-fall was cool, of course – – at February’s start, it looked like 2014 would finally be The Year Of The Bear – – but TPTB put a swift end to all that. What’s interesting to me, though, is that the real “rot” of the market didn’t really show itself until the past few weeks. While the mainstream media has been focusing on nominal highs in some indexes, there have been quiet bear markets going on in select pockets of the market.

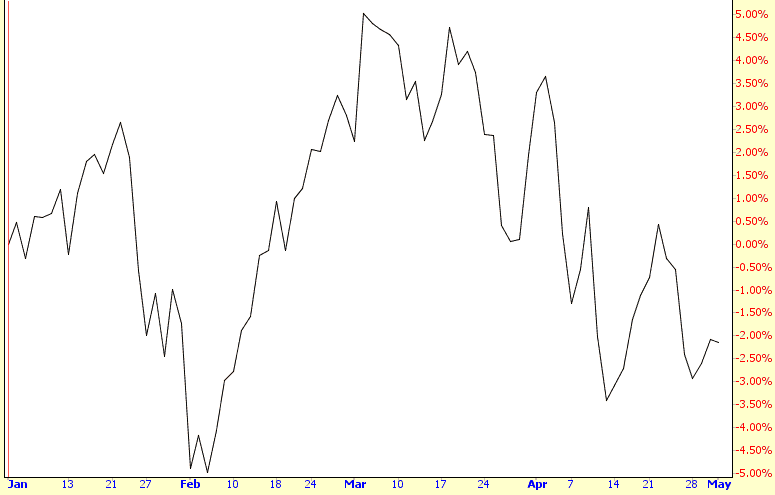

Small caps have been a lot more dynamic than the stodgy old Dow 30. They were much stronger than the Dow at one point this year (+5%) and are weaker to date (-2%). In other words, there’s more volatility and opportunity in the land of the small caps. Having said that, though, let’s all agree that a net 2% move over the course of 17 weeks isn’t exactly riveting.

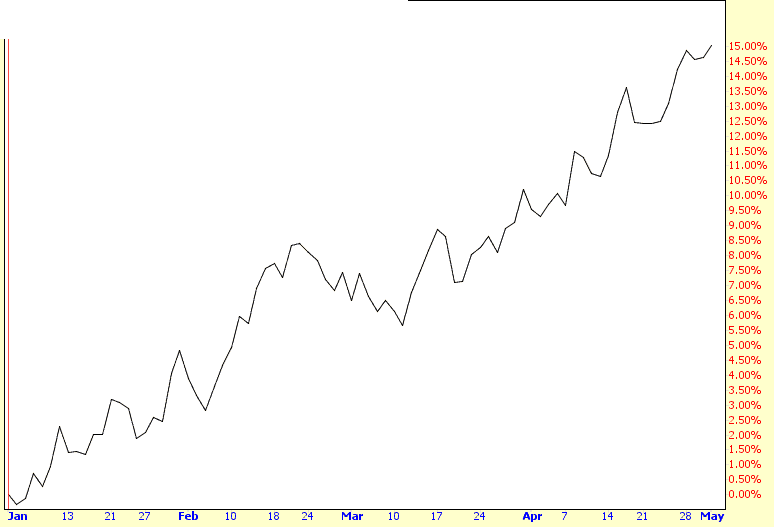

So where’s the action been? What’s the big winner? It’s in the most humdrum, dry, boring place you can imagine – Utilities! Just look at the percentage graph of the Dow 15 – – talk about strong and steady! Whoever decided to avoid 3D Printing, Chinese Internet, and Solar Companies and instead focus on the most godawful snooze-worthy industry on the planet sure made the right choice.

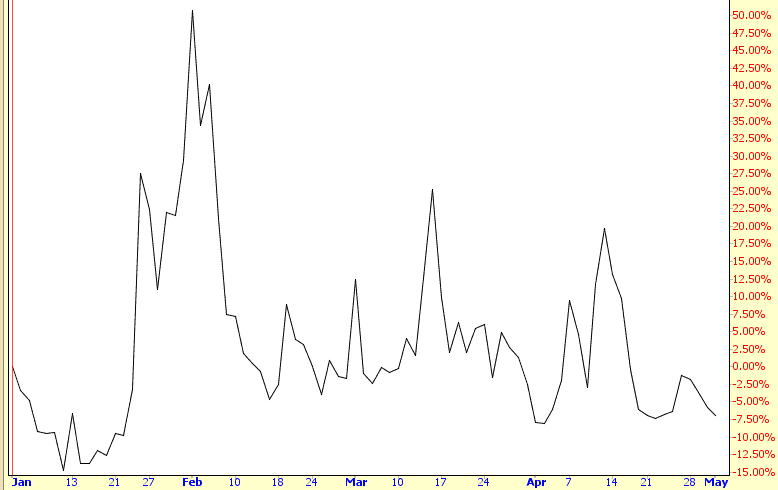

For me, the graph which kind of says it all is the percentage chart of the VIX. The VIX went absolutely rocketing late in January, only to be tamped down into a somniferous slumber. Come on, market! Wake us up! We’re all waiting!