“So how come you never buy stocks?”

That was the question “ryans” asked me at SlopeFest. I tried to offer an answer, but I didn’t have a good one. I’ve thought about this a lot over the years. Some possible answers might include…..

- In the mid-1980s, the first time I had enough money to invest, I went into a couple of limited partnerships. One of them lost 100%. The other something like 80%. My first taste of “getting in on the long side” was a very unpleasant one.

- The very first time I bought stock was October 19, 1987. Yep, Black Monday. Funny enough, I did the classic beginner’s mistake of averaging down in December (the stock was AAPL) and wound up turning a profit. All the same, finally giving in and buying stocks just like everybody else turned out to be unpleasant.

- The most money I’ve ever made investing, and it happened in a big, big hurry, was on the short side. For me, 2008 was the closest thing I ever experienced to owning my own currency press.

So I’ve obviously missed out on a lot. So, since I’ve had more conviction about NOT buying stocks than the most fanatical religious zealot would ever have about following the creed of their own faith, what finally coaxed me, after all these years? I’ll likewise offer up three things:

- The persistent and well-intentioned goading of Slopers;

- The plausible scenarios in which stocks will, in fact, just keep melting higher;

- My recent acquisition of precious metals (stored safely away in a remote vault location), whose appreciation has given me warm, fuzzy feelings, on top of the warm+fuzzy feelings of knowing that if the feces ever hits the fan, I’ll actual honest-to-God “money” at my disposal.

Of course, I’ve talked myself out of buying stocks for ages, and even at this late date, with all the reasons above, it was extremely difficult. The voices in my head kept saying things like:

- “It’s way, way too late. Five years ago would have been fine. Not now. The run is done.”

- “What if you buy now, and then the market finally crashes? You’ll look like even more of an ass than you do already!”

- “What about your “Tim=Bear” brand? Do you want to dilute that?

Well, I told myself it was “too late” in late 2009……….and 2010……….and 2011……….and 2012……..and 2013………and, oh, the first half of this year. And you want to know something? It was never too late.

What if the market crashes? Umm, well, great! I’ve got a buttload of puts that are already in-the-money and don’t expire for months, so they’ll do great, plus I’ve still got a huge number of short positions.

As for my “brand” – – I’d rather my brand be about “integrity, openness, candor”………..not, “always a bear, no matter what.” And I think what I’m doing and writing about feeds into the brand I really want.

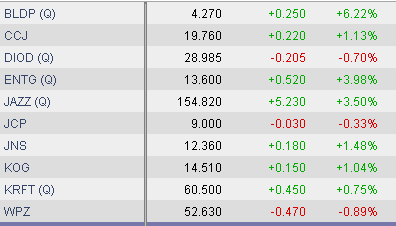

The funny thing, of course, is that of the ten longs I bought – – and I only just got them Friday – – seven of them are already profitable, even though the market barely budged.

We’ll see where this ultimate takes me. Who knows…….if my long plays start to blossom for me, I might make this into a habit. Only time will tell.