Of the past fifteen trading days, two – count ’em – TWO – have been down (and only slightly) as measured by the S&P 500. Since April 15, the S&P 500 is up about 7.5%. Every single day seems to bring a lifetime high – LIFETIME, mind you – to the stock market. You can imagine how delighted I am at all this. One wonders what on earth I’ll be able to write about this weekend.

In any event, the S&P 100, as shown below, is right at its long-term trendline. Next week sure as hell better start weakening, or else a bad situation is going to get a whole lot worse (and, with the VIX threatening to break into the single digits, anything is possible).

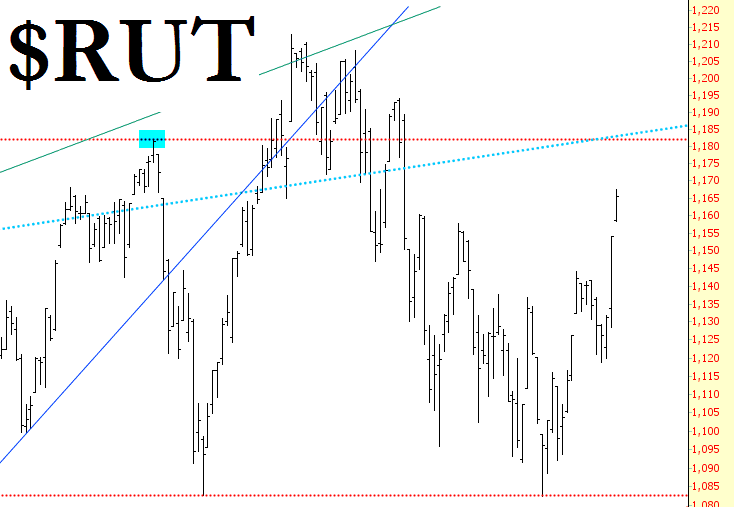

As for the Russell 2000, which until May 15th was the last friend of the bears – – it really needs to stay beneath 1182.04, marked with the cyan tint below. We are approaching a decision point, folks, where we find out if the bears have even a prayer in 2014 or if this is just going to be another murderous repeat of the five years that preceded it.