UNRELATED NOTE: I did a podcast interview last week which you can listen to here. The sound quality isn’t so hot (this was over the phone), but if you just can’t get enough of me yammering on about bubbles, you can enjoy it!

One of the ironies of “good times” like these (that is, when the market just keeps melting, in spite of the enfeebled efforts of the you-know-who crowd) I don’t have much in the way of ideas or suggestions. My “ideas” are essentially:

+ Keep tightening those stops as necessary;

+ Have a target in mind so that you don’t get greedy and overstay your welcome.

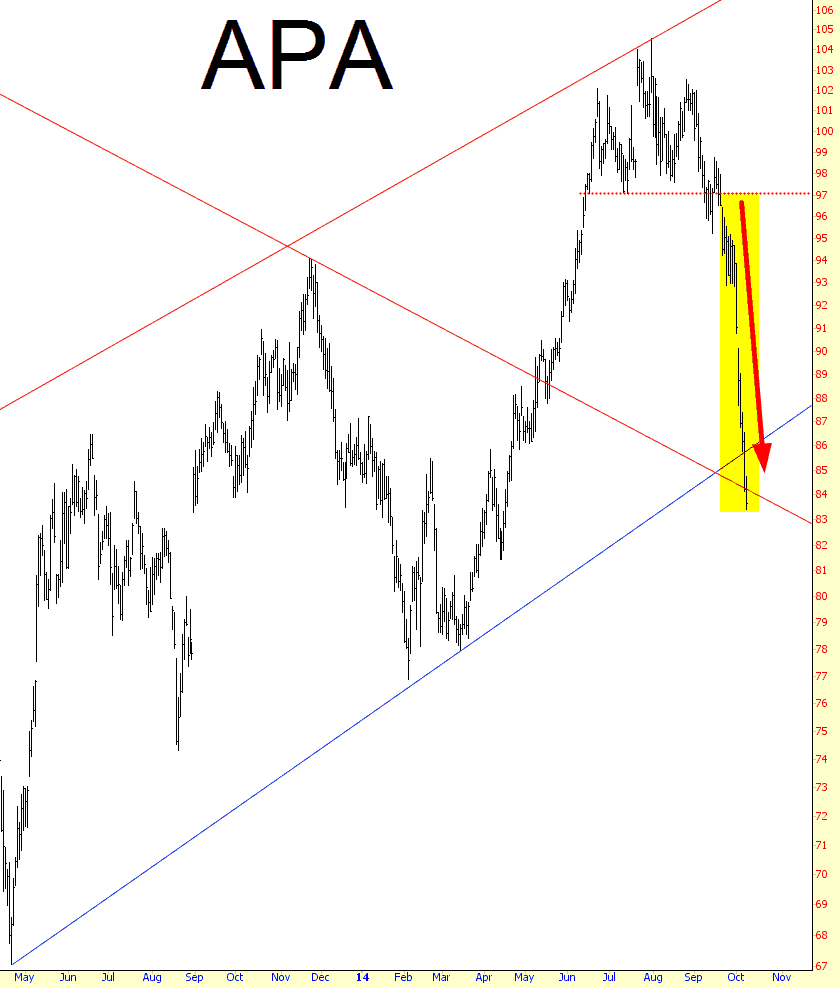

I don’t want to turn Slope into a horn-tooting forum (e.g. “I was right about this; I was right about that“) but here are a couple of related success stories that maybe have enjoyed their run for now. First is Apache, which I was wildly touting due to its wonderful diamond pattern (not shown here) and channel. It has behaved As God Intended:

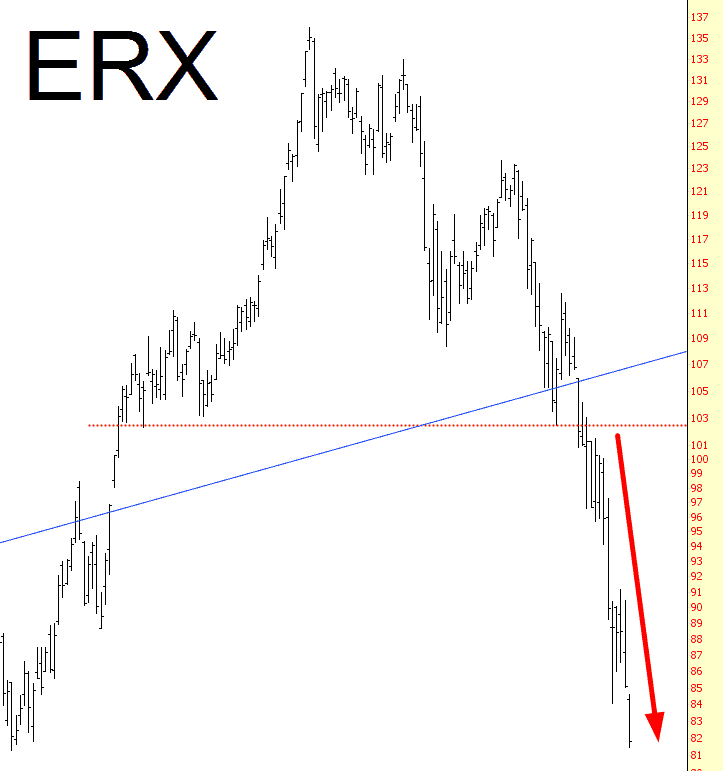

Similarly, ultra-bullish-energy fund ERX had a gorgeous analog (I don’t have a reference to the URL, but honest injun, it’s there in the archives) and it’s acting gorgeously. But, again, I’d be cautious of a bounce.

The thing is, during times like these, my worst enemy is my own fear, because I keep anticipating the bounces…………..and the bounces don’t happen. And that, my friends, is precisely why I’m stupid enough to have 160 positions. Because there’s no way dumb old Tim can shoot himself in the foot and bail out just because he doesn’t have the testicular fortitude to do what he needs to do. I have set my own trap.