I’ve got three laptops sprawled out across the surface of a hotel room table, doing a pretty decent job of keeping my trading world together. I thought I’d just give a general update as to what I’ve been doing today as well as suggest my attitude toward the market:

+There are a lot of stocks, particularly in the oil exploration sector, that are, on the one hand, ultimately going to be way, way, way lower than they are now, but on the other hand, look terribly prone to a bounce. I have thus trimmed back on several dozen positions, all at a profit, to anticipate a better entry price.

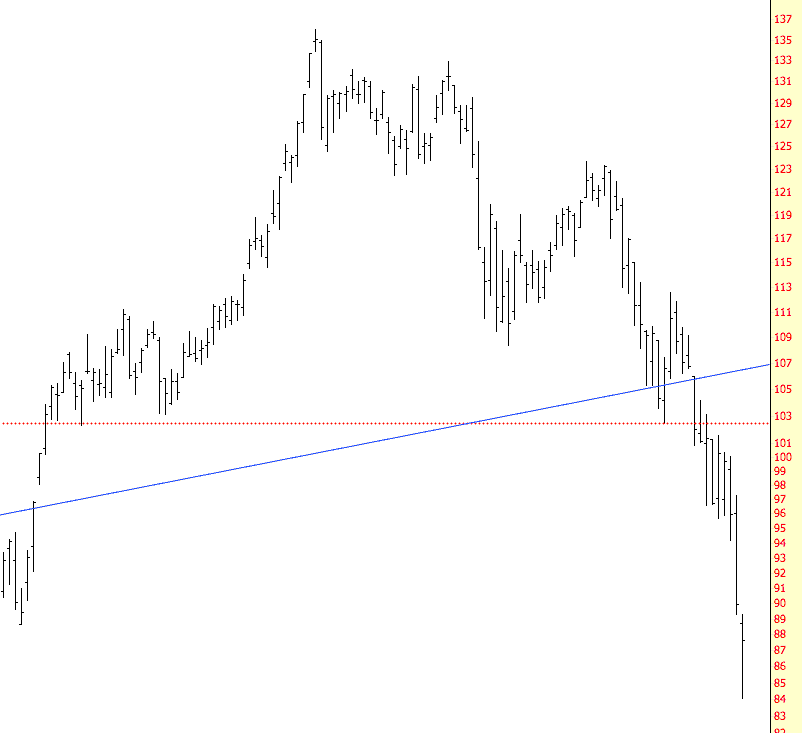

+ There have been some sensationally important price levels violated recently. I strongly believe the odds are becoming more and more in favor of the bears, in spite of this countertrend rallies.

+ I was really pushing deep into margin territory, at about 175%, but I’ve backed off to “only” 120% at this point, since things are very “stretched” to the downside in some areas. Today was a very good example of, just when things looked like they were going to go into an historic free fall, we got a stick-save. (My options account was amazingly volatile). The target price I told you Slope Plus folks about still applies, but we’re certainly not going to get there in one fell swoop!

A great example of the kind of success we’ve had lately is exhibited by ERX, which I did a post about last week. (Or earlier this week; I’m too bleary-headed to remember). It fell beautifully, precisely as I predicted, but before it really tumbles hard, I think it’s likely to take a breather (that is, a countertrend bounce). I hate bounces, but they’re a necessary evil, because they provide much better prices for shorting!