October is turning out to be far more “trick” than “treat” for equity bears.

At the midpoint of the month, things looked sensational. Stocks were breaking down left and right, and it seemed that we had finally encountered a sea-change in the market.

Since then, however, stocks have exploded higher with a gusto that I underestimated. I certainly expected a bounce, but nothing of this degree. Much worse, it seems that the cessation of QE (announced yesterday) has done nothing to slow the equity bulls down.

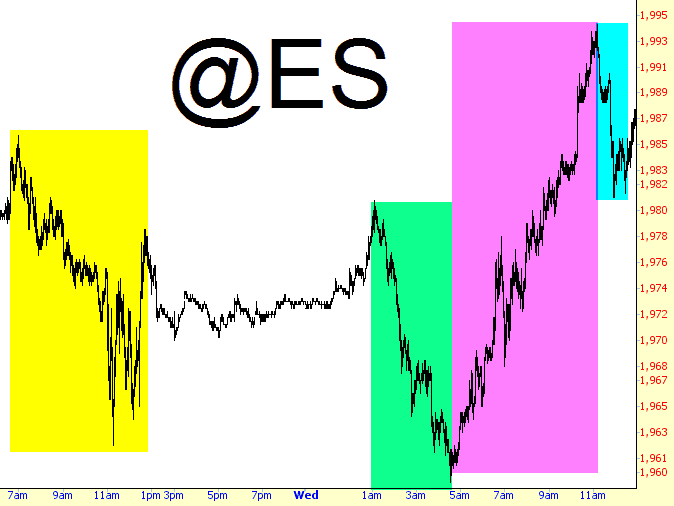

This kind of environment can really mess with one’s head. Let’s take a look at the past couple of days on the ES:

The yellow portion is yesterday, which is the time I thought I’d really need to man up and tough out a potentially horrific session. It turns out all my hand-wringing and worry were totally uncalled for: I had a profitable day, and QE was, in fact, terminated.

So the evening hours met with just a slight drift upward, and as I slept, the ES started eroding, tinted above in green. By the time my dogs were nudging me to go for their pre-dawn walk, the ES was down about nine points, and I looked forward to a terrific day.

Then the climb started, tinted in magenta. The red number on the ES got chipped away, and, almost incredibly, it was now green. My positions were hanging in there, concentrated as they were in energy, but the profit was definitely shrinking. Before I knew it, the P&L was in the red, and the loss started growing swiftly as the market kept lurching higher.

I was not a happy camper. As I’ve said, I deliberately maintain a ridiculous quantity of positions to prevent me from getting nervous and jumping completely out of the market. I take things on a stock-by-stock, stop-by-stop, basis.

Just when the pain felt unbearable, things started reversing, and for a while there, (tinted in cyan) it looked like things were going to return to where they were. The bulls fought back, however, at by the end of the day, I had a loss, although substantially smaller than when the market was rocketing higher, uninterrupted.

But I wanted to revisit that earlier point – – the point where “the pain felt unbearable”. Because, at that very moment, I came very close to doing something that probably would have been very stupid: dumping every single option position I have.

Now, as I mentioned, my equity portfolio is my big one, and these days it has a quantity of positions in the triple digits. My options account, however, had 21 positions, and although 21 is bigger than 1, it is still feasible to freak out and bail out 21 positions, just to stop the pain.

And I really, seriously considered stopping the pain, because what was going on was bewildering to me. I was just one slight nudge away from completely throwing in the towel. Three things stopped me, however:

(1) The options don’t expire until 2015 (most of them mid-January), so there’s gobs and gobs of time left;

(2) I told myself – – out loud – – “this isn’t personal”. In other words, I had to remind myself that no one was actually attacking me. This was a problem in logic and emotional control, not personal defense;

(3) A couple of weeks ago, a Sloper made an offhanded comment regarding options positions that he simply “closes his eyes and doesn’t get out until the profit target is met or they expire.” I actually found a lot of wisdom in that resolve.

In any event, I pulled my hands away from the keyboard and didn’t “blow up” my account. In retrospect, it would have been awfully hasty since, let’s face it, a lot can happen in twelve weeks!

The point I wanted to make is that it wouldn’t have been very long ago at all that I would have panicked and dumped everything. I have a strong feeling that, if I had done so, I would have spent the next three months looking in the rearview mirror, probably wondering why I had been so foolish. In the end, I suspect, I’ll be glad that I held on tight.