A few days ago I shared a signal on my blog going back 10 years defined by the SPDR utilities ETF (XLU) being down greater than 3% in a single day while SPX was above its 50MA.

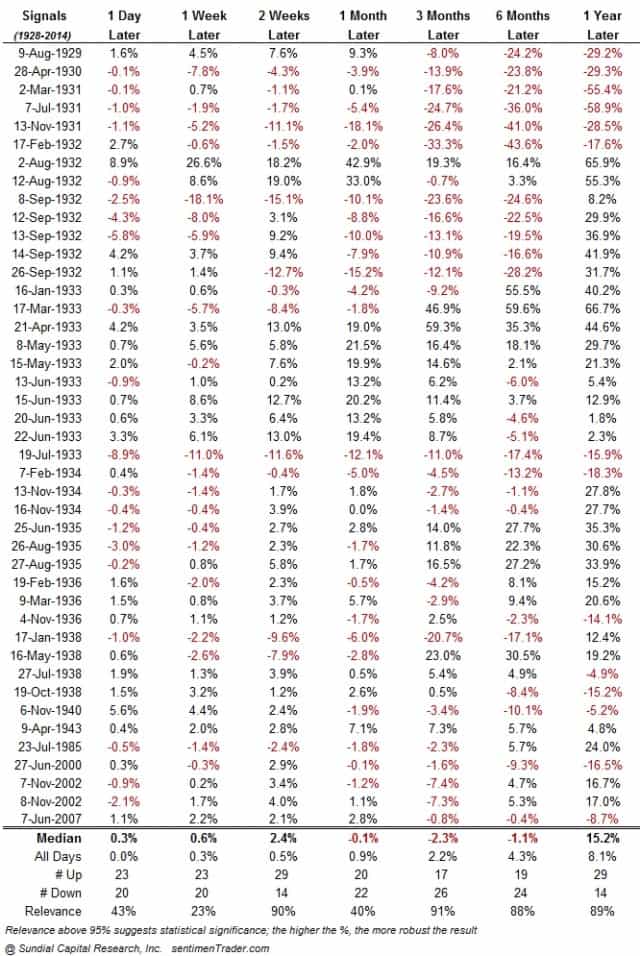

I reached out to Jason Goepfert at Sentimentrader.com (an excellent and thorough market analysis site, well worth the money which is nothing compared to what you get for it) and asked if he would be willing to backtest it further than I was able and let me know how it went. Being a top notch dude, he did just that. Here are the results…

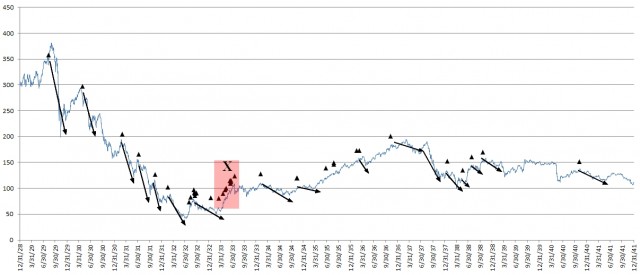

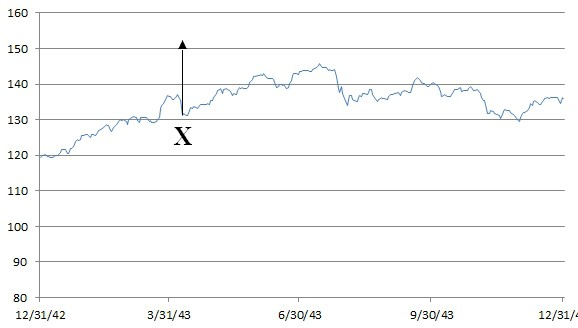

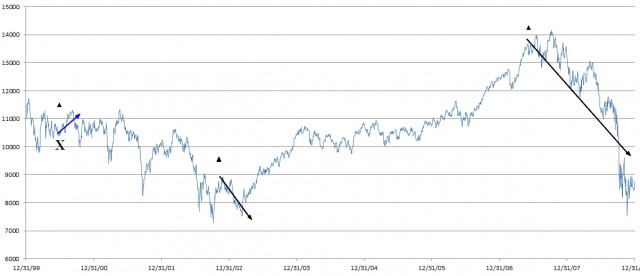

I did notice a signal in 2000 that didn’t occur in my backtest, so I suspect there are some minor differences between our individual comparisons, probably in what he chose to use to represent the utilities sector. Curiously, most of the results were prior to 1941. Then, after pretty much a 60 year gap, it has started up again. I’m more of a pictures guy so I wanted to chart these occurrences. Unfortunately, I soon found out that the S&P500 began in the 50’s, if I recall, so I went with historical DOW prices as a comparison. I was up late lastnight putting the spreadsheet together because I wanted to know so badly how it all looked. The results are fairly astonishing. Take a look below (remember you can click to see full size).

Needless to say, there is an overwhelmingly bearish tone to these results. Of course, it’s never a guarantee, but I would certainly not be falling in love with my long positions at this point.

Now I would like to reach out to any Slopers with a longer-term understanding of the market and how its changed over the past century. I would like to understand why this signal disappeared for 60 years and suddenly has come back in the past 15. If I had to guess, I would think it might have something to do with interest rates perhaps being that utilities are sensitive to such things, but I will leave that to the experts. Frankly, I’m more concerned with its reliability than the how and why of it.

Good.

Luck.

Bulls.