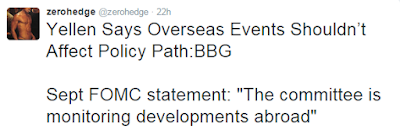

Just to add to confusion regarding what future direction the FOMC may take regarding whether or not to raise interest rates in 2015, we see this tweet last night…

I would just remind readers that Janet Yellen’s comments last night are HER comments and are NOT the official Fed Policy Statement that was released at their last meeting on September 17th. In their Release, they stated that…

“Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term.”

AND…

“To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.”

AND…

“The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.”

In my opinion, regardless of what Janet Yellen or any other FOMC member (or media pundit) may say in between their last Fed meeting and the next one, the only one that could be considered the official FOMC policy at the moment, is the one stated in their last meeting.