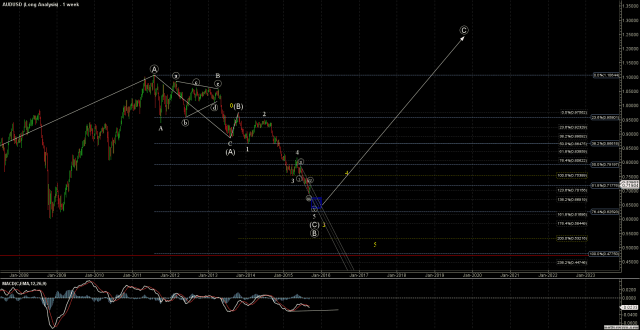

Since its July 2011 top at 1.1064, the AUD/USD has lost approximately 35% of its value. Interestingly it wasn’t until June 2013 that we really started to see this move accelerate to the downside. This was due to the fact that from July 2011 until June 2013 we were consolidating in a B wave triangle that ultimately resolved very strongly to the downside in a very large ABC corrective pattern. This is an important fact as it tells that the entire structure off of the high was what we call a corrective structure in Elliott Wave Terms. This helps gives us clues as to answering the question of if this multiyear down trend is coming to an end or if we can expect further downside action to continue.

To answer this question we first need to look at the pattern and first determine if we have enough waves in place to consider the pattern complete off of our 2011 high. The answer is that for a standard corrective pattern we do not have enough waves to consider this move complete off of the 2011 high. Of course there is always the possibility that we have bottomed in a complex corrective pattern; however, when attempting to determine probabilities from a trading perspective this is a lower probability pattern and we only would consider it plausible if we had evidence to suggest that it is in fact playing out. At this point in time we do not, so we are focusing on the higher probability pattern which suggests that a longer term bottom has not been struck, thus allowing us to expect a continuation of the trend down.

As I mentioned, the initial move off of the 2011 high was rather sideways in nature as it was a B wave triangle only starting to break down in April of 2013. This was the end of the wave B of the initial (A) wave down. We then saw a strong C wave down that hit the 100 extension of the initial wave A off of the 2011 high followed by a retrace higher for wave (B) of ((B)) that topped in October of 2013. In Elliott Wave Theory we expect to see a 5 wave move for a C wave after the termination of a B wave and it is this 5 wave move off of the October 2013 high that has yet to complete into current levels which is why we are looking for a continuation of our trend lower.

Now while I do not think we have stuck the ultimate long term bottom for this pair, my base case is suggestive that we may be just one more low away from having enough waves in place to consider a bottom. Now given the corrective nature off of the 2011 high, it is reasonable to project that after this bottom this pair will once again exceed the 1.1064 level. Of course after such a 4 year downtrend we will want to a see clear evidence that we have in fact bottomed in the form of a 5 wave structure off of the lows, a structure which thus far we do not have.

So what I am looking for from here is for us to be making a local top somewhere around current levels then make one more low into the 0.6717 – 0.6368 zone for a longer term bottom. Once this low is stuck we will be looking for a clear 5 wave structure to the upside that would suggest that we have made a longer term bottom. Now with that being said, if we exceed the 0.7597 level before we make a new low then we will have to explore a more complex bottoming pattern. Until and unless that happens however we are looking for at least one more low and a continuation of the trend into the end of 2015.

Originally published on ElliottWaveTrader.net by Mike Golembesky, who hosts our live Forex trading room.

Originally published on ElliottWaveTrader.net by Mike Golembesky, who hosts our live Forex trading room.