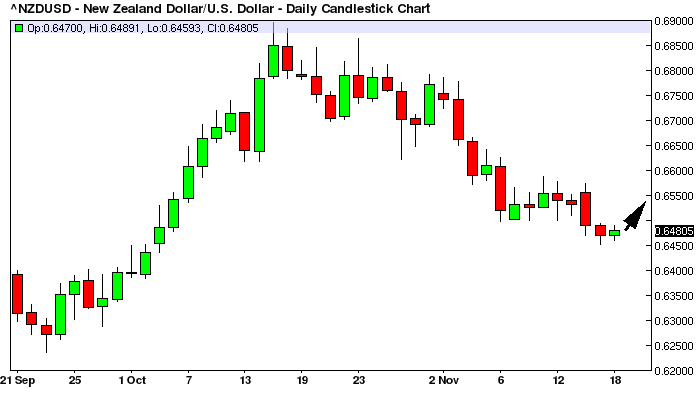

This would be a quick trade on NZDUSD, LONG, possibly targeting the 0.6546 target. NZDUSD has been up last week and up for the last 2 months (September and October, not November), we like it more SHORT than LONG, but a small opportunity for a quick profit is always worth trying.

This model below is our quantitative LONG model for NZDUSD LONG. What we do is to calculate statistically what price levels usually determine a trend reversal (i.e. a bounce), based on a very large databases that contains all the historical price retracements for this market since 1991, i.e. 25 years of data.

How to make money with this information? Well, is quite simple: buy the amounts recommended at each price level and sell at the profit target indicated, it’s mostly a mechanical system, many of our clients have been using it successfully since 2008 (for the record: you can also use the model in a more discretionary manner, e.g. to determine when a market is oversold and go LONG).

In this particular case below, you can see we will need around 39k USD to perform the entire trading cycle suggested by the model, but if you only trade one level, you can trade with any amount. If you did buy the first 2 levels, 0.6513 and 0.6486 and if the market goes back up to 0.6546 (quick target), the profit from current levels (trading at 0.6480) would be ~481 USD, which is about a 1.2% profit.

Click here if you want to gain access to all our quantitative trading models, we cover a number of selected ETFs, FX Spot, Indices and Futures markets (full list).

Keep in mind this is one quick trade and it is supposed to last 1-2 days max, so it would be quite a good profit for such a short trading time. We are going to repeat that people that dreams of multi-digit returns with options or scalping/daytrading are complete amateurs and not realistic.

In conclusion your goal must be always to make money safely, in time, trade after trade, and we believe our model can help every trader with that.

Click here if you want to gain access to all our quantitative trading models, we cover a number of selected ETFs, FX Spot, Indices and Futures markets (full list).