The market is now full of dollar bulls and the main reason there are so many bulls is due to the strong rally we have seen since May of 2014. Yet, any one left within the dollar bear camp is amazingly still screaming for the demise to the USD. Many have claimed, week after week, that the dollar is about to crash, but, alas, the dollar has had other plans, just as we expected back in 2011.

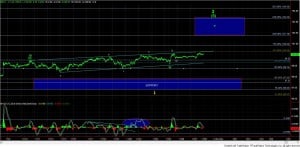

And, just as we were dollar bullish well before the masses have joined us, we are now going to turn dollar neutral very soon for the intermediate term. To that end, I believe the next year or so will likely frustrate both bulls and bears alike. You see, the market is now approaching the target zone for what we were expecting as the top of wave 3 off the 2008 lows. That means that the multi-year rally I was calling for back in 2011 is approaching a climax for wave 3. And, for those that know how to count, after wave 3 comes wave 4.

Now, 4th waves are consolidation waves. That means that once wave 3 tops in the near term, wave 4 will likely take us back towards the mid-90’s, and price will likely remain there for the better part of the next year. For this reason, I have suggested in the title to this update that I will be preparing for a “dormant dollar” in 2016 once we complete wave 3. (Click on each graph for a big version).

Originally published on ElliottWaveTrader.net, by Avi Gilburt.