You can see my original post of July 8th and four subsequent updates covering China’s Shanghai Index here for background information.

In my last update of September 8th, I noted that a bearish moving average Death Cross had formed on the Daily chart and price closed at 3170.45. Since that date, price moved sideways for over a month before it, finally, rallied to where it closed today (Tuesday) at 3604.80.

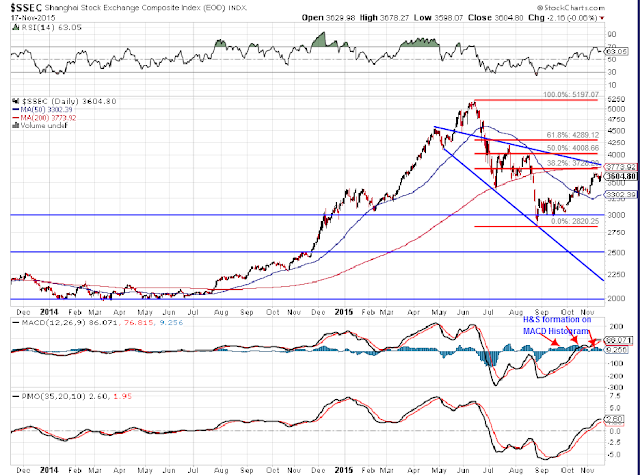

I have the following observations on the 2-year Daily chart below:

- both gaps down in August have now been filled

- a bearish Head & Shoulders has formed on the MACD Histogram, hinting of weakness ahead

- price is approaching a triple confluence major resistance level around 3750 (comprised of the 200 MA, major downtrend line, and a 40% Fibonacci retracement level)

- a re-test of a 200 MA is not uncommon after a Death Cross has formed and price usually drops afterwards, often to new lows

I wouldn’t be surprised to see some major selling come in sometime soon on this index to, possibly, take price down to around 2500, or lower (what would be Wave 5 for Elliott Wave enthusiasts).