Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

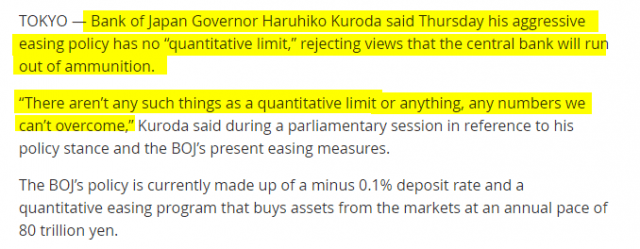

Pride Before the Fall

When I saw this article yesterday, I could hardly believe what I was reading. I have never in my life read such naked hubris from a central banker. You just know this remark will be quoted in history books decades from now.

Without You

I’ve been online, in one way or another, since about 1982 when I got my first 300 baud Lynx modem. During the many years since, I have acquired what I think is a pretty strong sense as to the rhythm, timbre, and pulse of a given online community. In many ways I’m more comfortable with an online group than with a live group of people.

If I chose to do so, I could spend a lot more time in Slope’s own comments section. I could make a lot of comments on my own, try to guide the conversation, gently scold people whose behavior seemed to be getting a bit out of line, and so forth. I do not spend much time in comments, however, for many reasons. Broadly stated, I’m really busy, and let’s face it, with Slope in its 12th year, I would hope that the community could, by and large, manage itself.

Looking at the RUT Triangle

The short term patterns on SPX, NDX and RUT from Tuesday’s Yellen spike broke down and are forming likely bull flags here. I’m expecting to see those go a bit lower today before breaking up to at least test yesterday’s highs. They may reverse at that retest. The ES chart looks supportive of that scenario, though I’m struggling to find another chart to back that up. ES Jun 60min chart (from last night):

RTN Poised for Upside Thrust

All of the action in Raytheon Company (RTN) since its Dec high at 129.99 has the right look of a completed, or nearly completed, digestion period in the aftermath of the prior significant upleg off of its July 2015 low at 95.32.

As long as important near-term support at 120.50 to 119.45 retains the integrity of the high-level digestion pattern, I want to be long RTN in anticipation of a forthcoming thrust to new highs.

The upside from yesterday’s low at 120.24 to today’s high at 123.88 suggests strongly that RTN has established and pivot point within its bullish digestion period, ahead of upside acceleration.