“A foolish consistency is the hobgoblin of little minds, adored by little statesmen and philosophers and divines.” – Ralph Waldo Emerson

Slope has, over its nearly eleven year history, garnered a reputation for honesty. I make every effort to be completely forthcoming with my thoughts about trading, even when it’s going lousy for me, as it has over the past four weeks. I think this is more helpful than trying to “spin” things as many other analysts do, making it seem like they’ve never made a single misstep. This is going to be one of those “dangeorusly honest” posts, because 2016 has been a disappointment to me so far, even though it needn’t have been so.

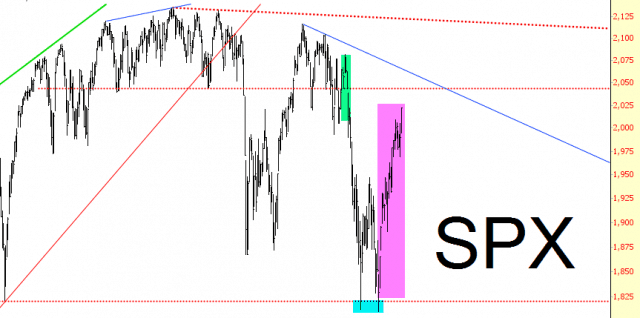

Although there have been hundreds of “moments”, both good and bad, so far this year, I thought it best to break down my analysis into three simple chunks, each of which represent a core error on my part. I hope that in doing so, not only can I help myself think through where I went wrong, but I may also be able to assuage some of the pain others may be experiencing who have gone through something similar. I’ve marked these “events” on the chart shown here, with the tinted areas from left to right marking each of these three zones.

The first mistake, strictly speaking, didn’t happen in 2016, but its effect did. As regular readers may recall, I decided to take the final week of 2015 off, going completely flat and into cash, for the sake of preserving my hard-won profits from 2015 and avoiding any end-of-year shenanigans. Beginning on December 29th, the market reached a peak, and it started a hard slide all the way down to its January 20th low. The FOMO-pain I felt during the 29th, 30th, and 31st of December and the 4th of January was just horrible, and I felt like an idiot. I discovered that the discomfort of missing out on downside market action (my favorite kind) was horrendous compared to the risk incurred with staying in positions. I was able to get myself into position on the second trading day of the year, but I easily missed out at least a 5% profit just by being AWOL for those few days.

The second mistake was marked by two dates, January 20th and February 11th, which in retrospect we can quite plainly see was an important double bottom. The error here was not taking advantage of an entire sector that was horribly and obviously oversold: energy. It’s not like I was unaware of the opportunities here: on February 15th, I published for my Slope Plus readers a ticker symbol list I dubbed the “Nasty Ninety“. Without exception, every single of those 90 stocks would become profitable, and a month later that had moved, on average, to about a 20% profit. My refusal to be a contrarian in a bullish direction was a big failing. In my defense, I would point out that for months energy stocks had seemed like they had made a bottom, only to stumble to even lower prices, so frankly I was too scared to grab hold of all those falling knives.

The third mistake, and the one I regret the most, was not completely bailing out of my shorts on February 11th. I remember precisely where I was and what I was doing when the market was bottoming that day, and I felt completely content to stay put, even though my trading friend Northy was warning me that things were about to turn higher. (I have since that time garnered a hefty amount of respect for what Northy says). I had felt at the time that we were about to break support hard, instead of bouncing like we did on January 20th, so I wanted to stay the course. You can plainly see what happened since then: an entire month of a near-vertical ascent. It’s been awful.

The regretable detritus of all this is my state of mind, because it can poison clear thinking about present market conditions. When we were sold off quite a lot lower, a lot of technicians pointed to the 2000 area as the time to get back in. Looking at all the gaps that were created between December 31 and January 4, it does seem quite compelling to believe that the closer we get to closing those gaps, the safer it is to get aggressively short.

I find it difficult to do this, however, due to the recent history I outlined above. Had I been more nimble (and thus would be sitting on a hefty profit by trading better this year), I’d feel a lot more confident about doing what the charts are suggesting, which is to get strongly bearish in the days ahead, particularly once Yellen is out of the way on Wednesday. But I just don’t have the courage.

My life is strangely beholden to the market, and particularly whether the market is bearish or not. If stock prices are falling, then everything goes right for me: my trades are profitable, Slope Plus gets popular and garners new subscribers, and traffic to Slope picks up. If stock prices are soaring, then the opposite happens across the board. (Although I must say that both Slope readers and Plus subscribers are remarkably patient and understanding; I mean, let’s face it, 7 of the past 11 years have been almost straight-up in equities, and Slope is still going strong.)

So that’s where things stand. For those of you who have ridden the waves well thus far this year, I congratulate you, and I salute you. I want to apologize for any instances of my “acting out” when I was feeling frustrated, and I’m very grateful – – particularly to Slope Plus subscribers – – for your presence here. If nothing else, I hope the charts and commentary here on the blog, both from me and other contributors, have been helpful sources of ideas. I hope not to screw up nearly as much for the balance of 2016. I’m certainly going to give it my best shot.