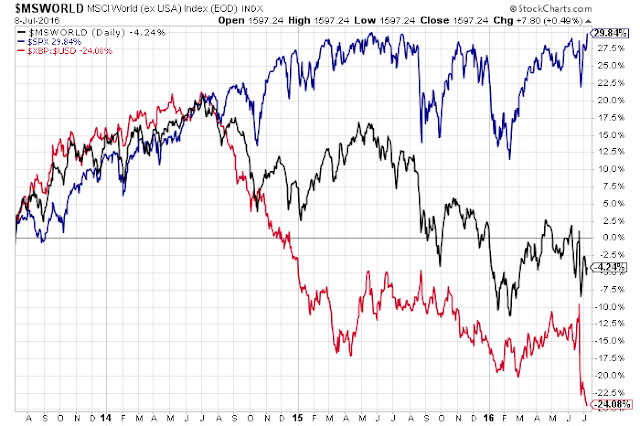

A new frontier awaits for U.S. equity markets to explore. They are fairing much better than other world markets, in spite of the Brexit uncertainty, and look poised to press upwards (likely choppily) for awhile, as shown on the 3-year comparison chart below of the SPX, World Market Index, and British Pound:USD Forex pair.

However, the closer we get to the U.S. Presidential election in November, we may see upward momentum begin to flatten out.

The World Market Index will, however, need to break through and hold above the 1600 major support/resistance level, once and for all (soon). If so, we could see such a breakout rally occur in the SPX — possibly in a manner as I described in my post of July 1st.

Otherwise, if this index weakens, with sustained force, we may not see sufficient appetite for equity risk in the U.S. markets to push and sustain them to new heights.

Each candle on the ratio chart below of the SPX:VIX represents one year. (My latest post referencing this ratio, complete with updates, can be read here.) So far, the body of this year’s candle is forming a bullish engulfing candle of the entire 2013, 2014 and 2015 candle bodies. As well, price closed above a major bull/bear line-in-the-sand resistance level of 150, once again, on Friday.

If we see price on this ratio hold above 150, we’ll likely see the above scenario play out for U.S. equities. And, currently, momentum is favouring the bulls (albeit cautiously), as shown at this link to a Year-to-date graph showing gains/losses for the 9 Major U.S. Sectors. I’d keep a close eye on the Financials ETF to see if they suddenly weaken relative to the others, especially if banks in Europe begin to fail. If so, I believe this would negatively impact the rest of the U.S. markets.