First off, in case you’re wondering where I am……..

What a terrific day (Hillary notwithstanding). The markets barfed. One of my kids medaled at the National fencing tournament. And I was absolutely delighted to see the return of a certain beloved Sloper:

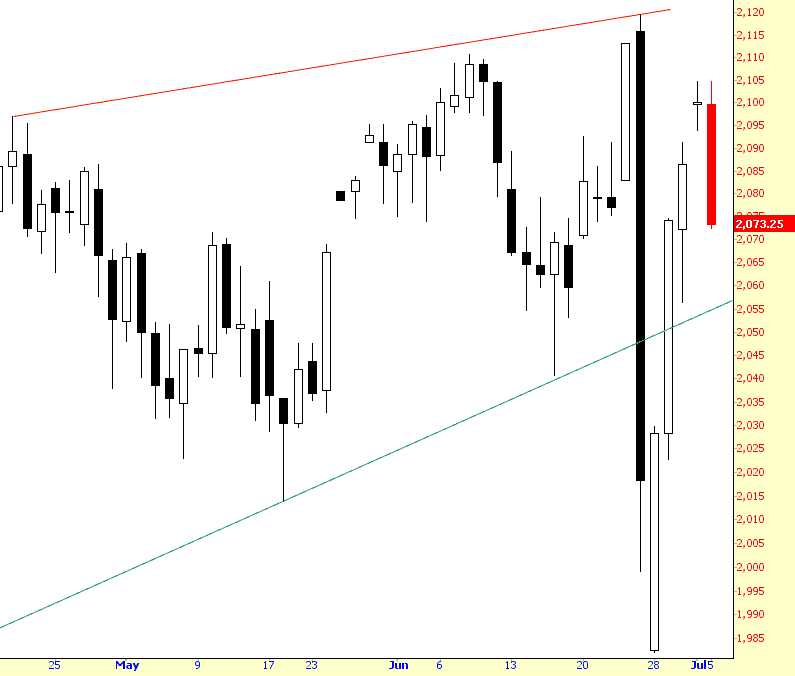

As I’m typing this on Tuesday evening, the ES is continuing to weaken. I came into the week with 80 short positions, and I’m very heavily loaded deep into margin territory.

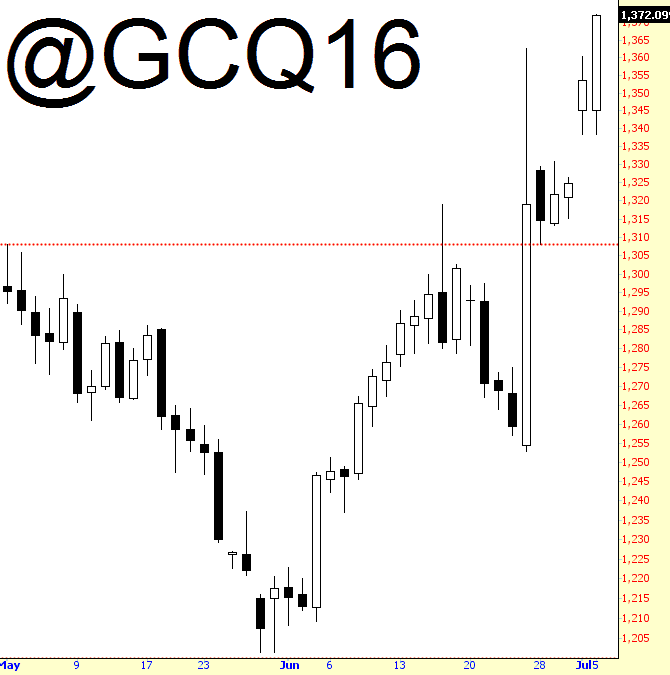

For most of this year, I’ve been bullish on two and only two areas: bonds and gold, both of which continue to do fantastic (and never seem to stop). Gold is getting deliciously close to the psychologically-important $1400/ounce level.

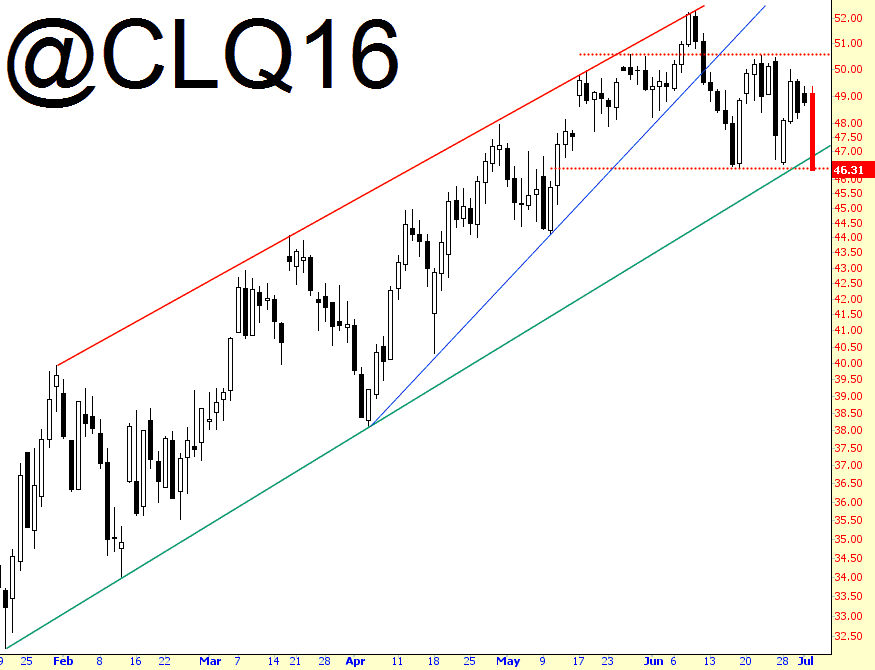

Far and away the best news for me today was crude oil, since there is no sector in which I have more shorts (the second of which is banking, which also crumbled today). Crude fell nearly 5%, and it’s shattering some very important support levels at this very moment.

I’ve already mentioned my disposition toward Q3 of this year: more bearish than I’ve been in years. Here’s hoping it continues to pay off.