NOTE FROM TIM: The item below was written by Avi at Elliott Wave Trader. Speaking for myself, I am bearish on gold (and even moreso on miners). I am short GDXJ and have a long position in JDST. Here, on the other side of the coin, is Avi’s point of view…………

First published on Sat Jul 15 for members of ElliottWaveTrader.net: While I would love to suggest that we have begun the next larger degree rally already, the market has not provided me with strong indications that is going to be the case just yet. While there are many indications that the market may have already bottomed, there are just as many indications that we may see the dreaded one more lower low before a lasting bottom may be seen. But, I believe an investor should be preparing now for an impending rally which I believe will likely take hold over the coming weeks.

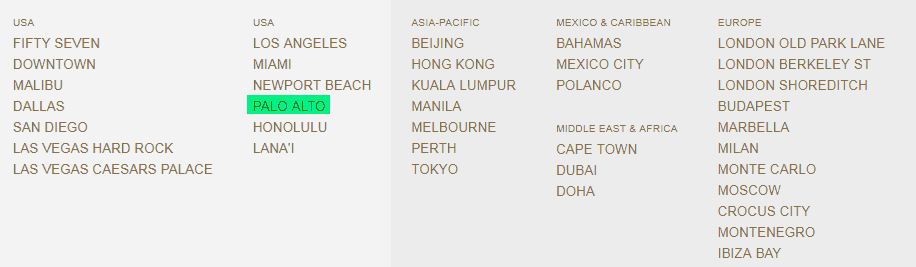

Now, whether we see that lower low or not, I want to highlight something of which you should definitely take notice, especially if you are bearish this complex. Please take a look at the attached daily GDX chart.