Note from Tim: I got a nice email from a Sloper who thought the blog could use some trades more at the beginner level; he kindly included two of his own to get things started. Here is the first…….

This is the first post of hopefully many more. The concept is to post a trading idea that starts a discussion about the trade. The post is for novices like me to learn from each other especially from the experienced Slopers. I have laid out the basics of the company, the trade idea and then the charts. As you can see, the charts are very basic and hopefully will become more sophisticated as experience and feedback occurs. Please join in the trading discussion:

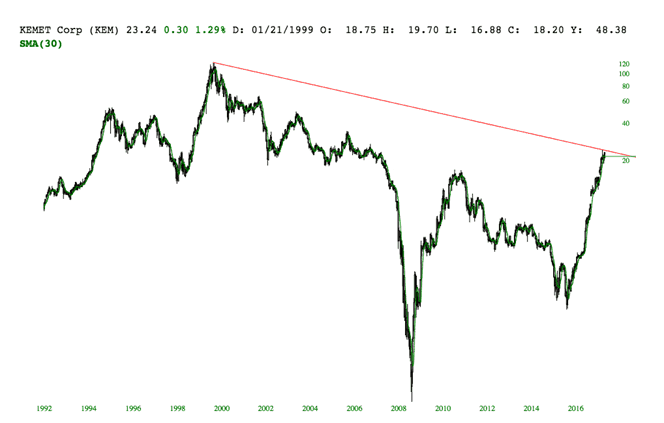

- Kemet Corp (KEM) – Manufacturers capacitors for electronic OEMS. EPS is projected to increase 292% for 2017 and 4.4& in 2018.

- IBD has a very high composite rating of 99 (out of 100) and ranks their industry group very high

- Zacks rating is a 3 (1 – 5 rating, 1 strong buy, 5 strong sell), and average analyst rating of bullish (9 analyst).

- Stock has fair liquidity, earnings release 11/7

The trade idea is to sell a Nov 17 $22 put @1.37. 6.2% return if held the full 44 days. Expected move is 3.68, current price is 23.24.

The charts below show that the price is bumping up against a trendline that started back 5/2/2000. The question is will it break above the trend line or at least stay above the green trend line on the second graph and thus a good trade or will it fall back as it did in 2000. I sold a $20 put on 9/29 at $1.30 and am thinking about the entering the trade idea above. Thoughts?